YouTubeReal Vision

- The price of Bitcoin will hit $1 million in five years, up from around $11,000 right now, thanks to an “enormous wall of money,” a former Goldman Sachs hedge fund chief said in a recent interview.

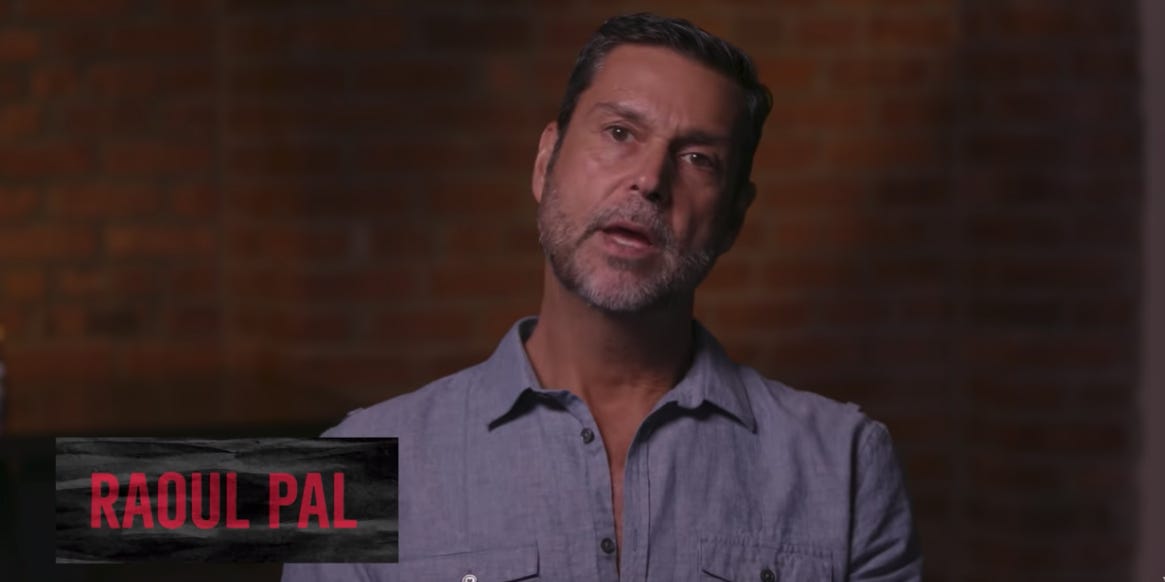

- Raoul Pal, who has allocated more than 50% of his capital to Bitcoin, said a wave of institutional funds will adopt the digital currency, as they realize the economy will take a long time to recover from COVID-19.

- “It’s an enormous wall of money,” he said. “Just the pipes aren’t there to allow people to do it yet, and that’s coming, but it’s on everybody’s radar screen and there’s a lot of smart people working on it.”

- Visit Business Insider’s homepage for more stories.

Raoul Pal, the former Goldman Sachs hedge-fund manager who founded Real Vision, said the price of Bitcoin will hit $1 million in five years.

In an interview with Stansberry Research on October 7, he pinned the predicted price increase to a wave of institutional funds pouring an “enormous wall of money” into the asset.

Bitcoin’s price has exploded about 40% year-to-date, and is currently worth $11,387. It is also the largest digital currency by market capitalization, with a current value of about $200 billion, according to data published by Statista.

“Yeah, I think [$1 million is] about right. Just from what I know from all of the institutions and all of the people I speak to, there is an enormous wall of money coming into this,” he told host Daniela Cambone. “It’s an enormous wall of money. Just the pipes aren’t there to allow people to do it yet, and that’s coming, but it’s on everybody’s radar screen and there’s a lot of smart people working on it.”

Pal, currently the co-founder and CEO of Global Macro Investor, said the global economy is moving from the “hope phase” to the “insolvency phase” as investors realize an economic recovery from the COVID-19 pandemic will take much longer than anticipated.

“The economy is not going to recover for a lot longer than we expect,” he said. “There’s no stimulus around and we’ve got more problems to come in Europe, the US, and elsewhere. And businesses don’t have enough cash flow, they’re closing in droves and that’s what I called the insolvency phase.”

“The only answer is more from the central banks, so that’s why I started to buy more and more Bitcoin,” he added.

At one point, Pal’s portfolio used to be equally distributed between dollars, gold, equities, and Bitcoin. But during the interview, he disclosed that the percentage of Bitcoin he holds is “probably above 50% now.”

He admitted that the above 50% allocation exposes him to a significant downside, but accepts that as the upside is “so much bigger.”

“My trading positions are relatively small because I don’t think there’s as much opportunity as the room is in Bitcoin. So really, mainly a bit of cash, some gold, and Bitcoin,” he said. “And I’m even toying with the idea of selling my gold to buy more Bitcoin.”

Bitcoin could also be propelled by the Federal Reserve’s high global quantitative easing program, according to one of the billionaire Winklevoss twins.

“The Fed continues to set the stage for Bitcoin’s next bull run,” Tyler Winklevoss, Gemini crypto exchange co-founder and CEO, said in a July 22 tweet.

Winklevoss believes the US dollar is no longer a “reliable store of value,” and there is no better time to buy Bitcoin than now.