Hedge funds hopped out of healthcare ahead of the US presidential election – and may have missed on a big rebound in that sector in the wake of Donald Trump’s win.

S&P Global Market Intelligence tracked hedge funds’ stock holdings for the third quarter, which ended September 30, more than a week before the November 8 election.

The takeaway? Hedge funds “may have been just as surprised by the election as pollsters and psephologists,” S&P says. The general thinking was that Hillary Clinton as president would have reformed drug pricing in a way that would have adversely affected the sector.

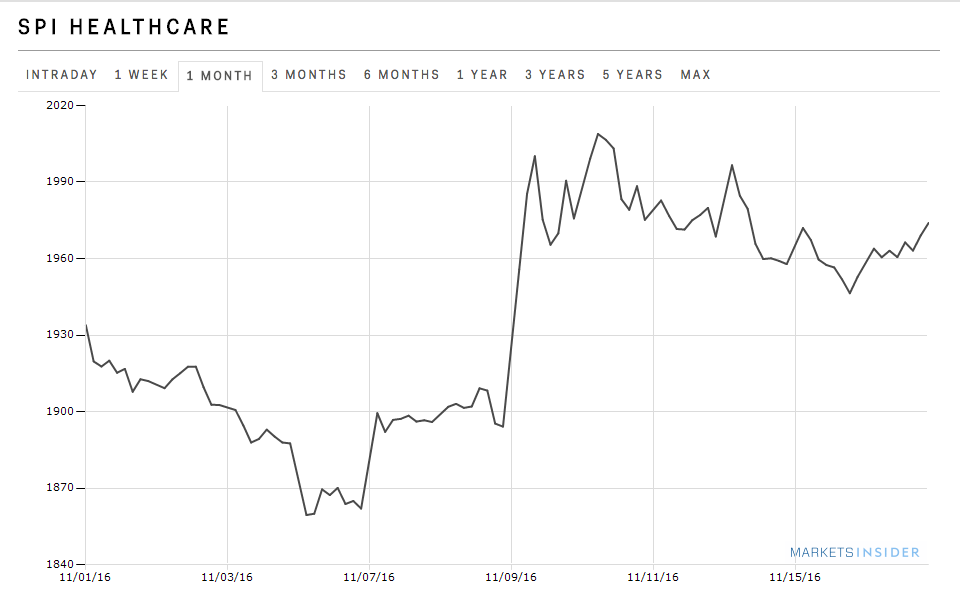

After Trump won, healthcare stocks bounced.

Healthcare was the biggest net sell for hedge funds, with energy following up.

S&P

S&P

Meanwhile, funds including Glenview Capital and Viking Global “pulled out significantly from Allergan, which was this quarter’s top sell at $1.5 billion,” the report said.

S&P

S&P