Today was part one of Y Combinator’s two-parter Summer 2020 Demo Day, where nearly 100 companies debuted their efforts to the world for the first time.

The Summer 2020 batch of companies was the first fully remote YC cohort, with the ongoing pandemic leading the accelerator to take its program entirely virtual. But it was actually YC’s second virtual demo day; as the severity of the pandemic became more clear back in March, YC moved the Demo Day portion of its Winter 2020 class to virtual at the last minute. Doing so meant dropping key aspects of Demo Day… including, most notably… the demos. Instead of live pitches, each company in the W20 class pitched via a single slide and a brief text description of the company.

YC clearly had a bit more time to prepare this time around, with a Demo Day experience more in line with that of the in-person events. In an incredibly rapid-fire series of live pitches, each company got just 60 seconds to pitch to an audience of investors, media, and fellow founders; it was enough to present the surface of who they are and what they do, but often left the deeper details of how/why for follow-up conversations.

Here are our notes on each of the companies that presented today:

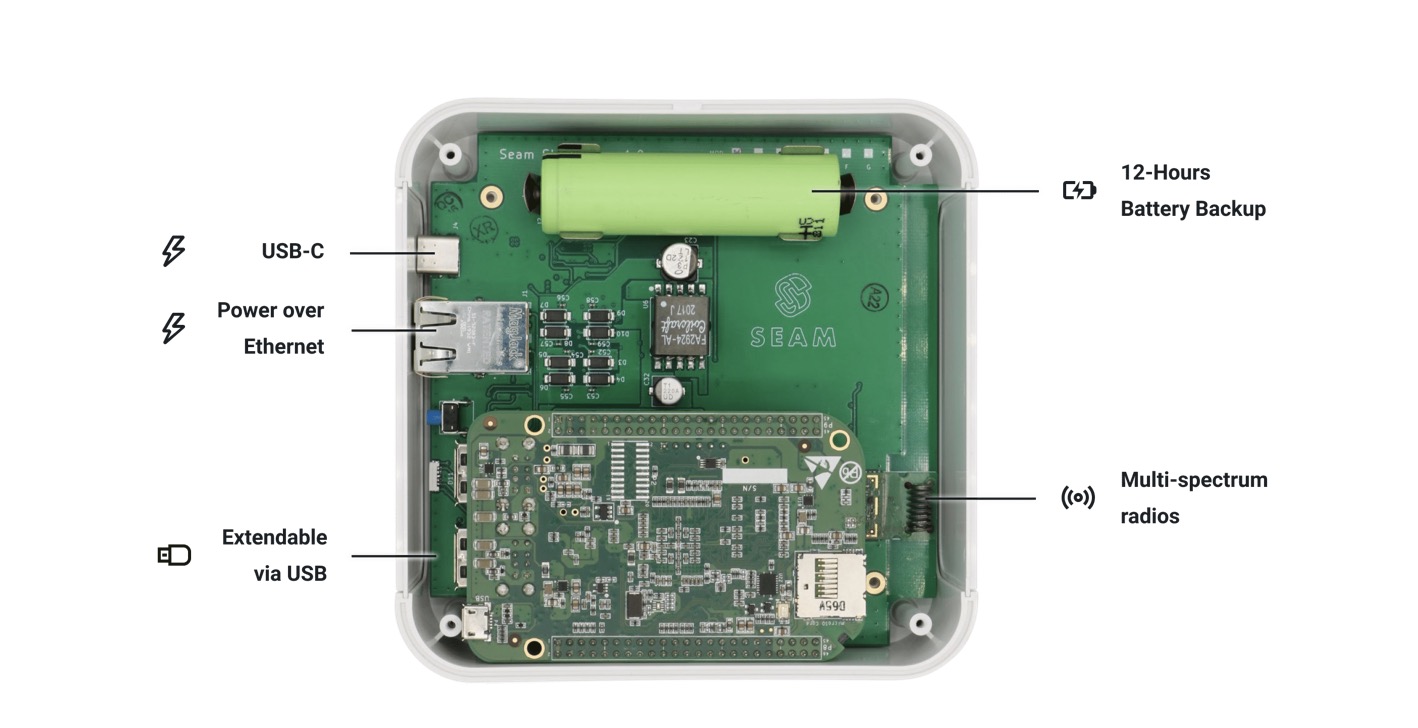

Image Credits: Seam

Seam:An API for homes and buildings, with a hardware hub meant to help developers build apps that can do things like unlock doors, summon elevators, etc. from different device vendors. Currently in 5 pilots.

Evergreen: A digital solution for employees to request purchases and track approvals. The B2B business is built for companies with non-centralized purchases and the need to manage a slurry of different tools.

Farmako Healthcare: A million doctors in India still use paper medical records. Farmako aims to help shift them to electronic ones so they can write prescriptions and see patients online easily and keep records centrally.

Polyops: SaaS business that provides analytics on e-commerce operations including visibility into returns, shipping and customer acquisition expenses. The startup wants to make e-commerce more efficient. Polyps claims 15 brands are already onboard with a combined $35 million in GMV. As commerce of all sorts changes, Polyps is trying to make the world a bit easier to grok, which seems like a smart direction to proceed.

Adyn: This startup is building a test to help women in the US determine which method of birth control is the best fit for their bodies in order to minimize side effects. The company says more than 49M US women struggle with birth control side effects. Once users submit their tests, the company gives them recommendations and can connect them with specialists to discuss options.

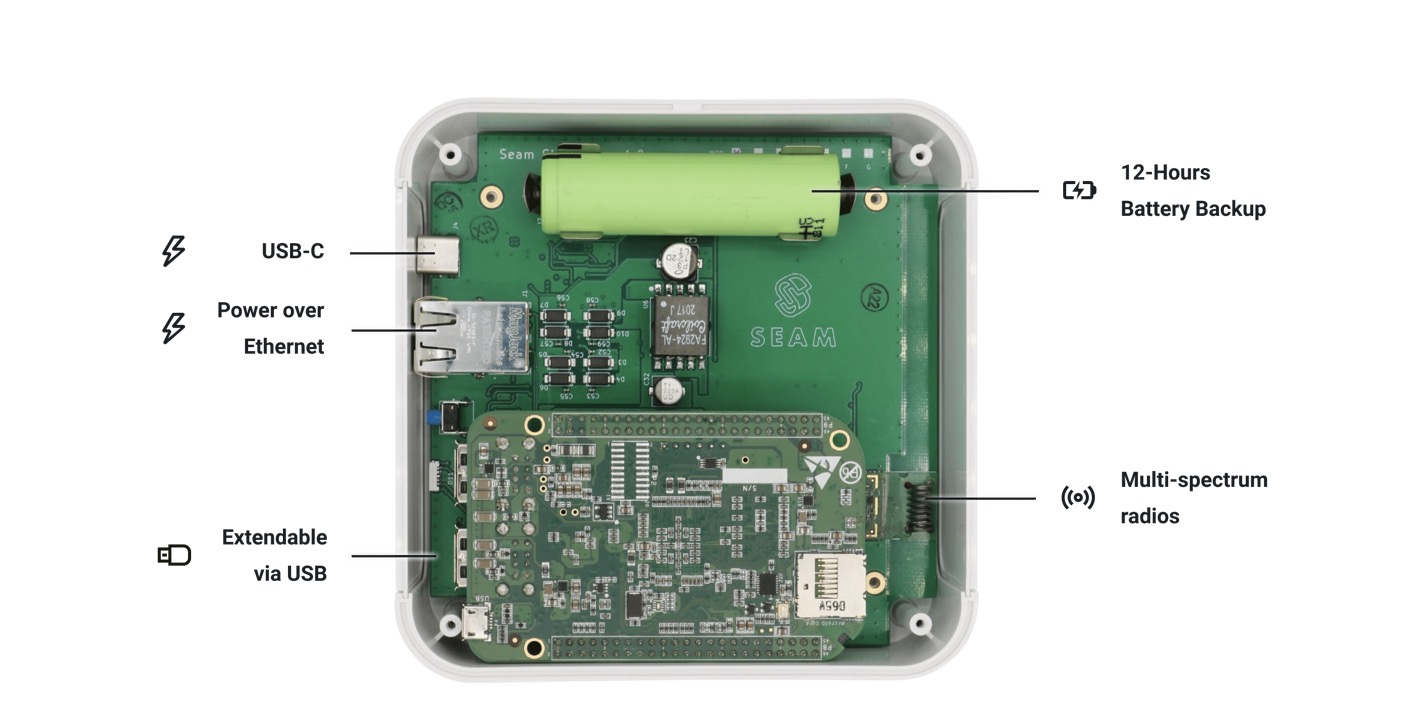

Image Credits: Akiflow

Akiflow: A command line-style tool for building quick shortcut commands across things like email, Google Drive, Slack, or Asana. Available on Windows/Mac. Currently has 2000 users waitlisted.

Inspectify: A software company that helps real estate agents coordinate inspections for home-sellers. The startup wants to grow into a managed marketplace that serves as a broker for all home services, from repairs to insurance.

Bikayi: Shopify isn’t a good match for consumers in the Indian market because of consumer habits that differ from those of the US (for instance, many purchases are made through WhatsApp rather than the web.) The founders started Bikayi after seeing family businesses using pen and paper to handle incoming orders online. They charge merchants $100 per year.

Atomic: A software company that provides a fintech API allowing other platforms to integrate investment accounts into their product, easily. Many modern fintech services allow you to hold cash, like Venmo and Apple Pay. That money could be, instead, invested. Atomic has found some initial traction, with a few companies signed up that give it around $300M in AUM, providing the startup with $1.5M in ARR. After every fintech added checking accounts, perhaps investments accounts are the next step.

Blue Onion Labs: This financial services startup is helping companies make sense of financial transaction data that lives across multiple systems. Their suite of API integrations are aiming to solve a big pain point for accounting teams, serving as a “single source of truth” for understanding the full scope of incoming transactions.

Fancy:Delivery of convenience store items, with delivery promised in under 30 minutes. Currently focused on the UK. Instead of picking up items from existing stores, Fancy operates its own “dark stores” to keep margins higher.

BukuWarung: A micro-accounting app for merchants in Indonesia. It enables mom and pop stores to bring payments and credit to their businesses. The service currently has 350,000 monthly active merchants.

CoreCare: Shuffling data between the hundreds of insurance companies, healthcare providers, and government entities can lead to errors that cost billions per year and can delay treatment. CoreCare synchronizes patient data between them, preventing errors and saving everyone money.

HotPlate: HotPlate is a service that helps unemployed chefs cook food at home, sell it, and deliver it. In its first 8 weeks the startup has secured 10 chefs which are generating around $1,500 in GMV. HotPlate takes a 15% cut of that total. The startups argument is that COVID has changed the world so much that, now, we’ll all want home-cooked meals instead of, we presume, restaurant-prepared food. We’ll see. And given the small GMV generated by each onboarded chef, how the economics will work out over time will prove interesting. Perhaps order size will grow.

ChatPay: ChatPay is building a Substack for WhatsApp, building out a platform that allows people to create exclusive WhatsApp chat channels while allowing admins to monetize the platform via member management.

Electry: A tool for hiring mechanics and electricians, pitched as “LinkedIn for skilled blue-collar workers”. The team says it’s currently seeing $75k monthly revenue, and is profitable.

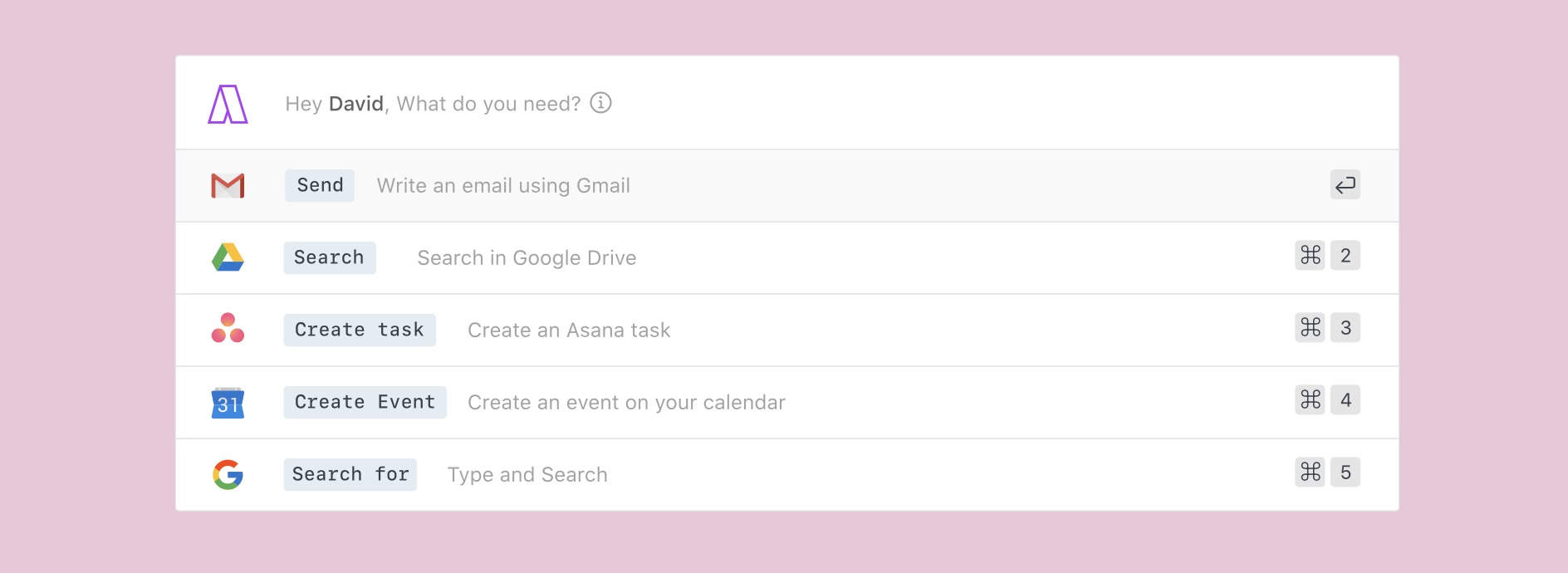

Image Credits: Clew

Clew: We live on so many different cloud-based platforms, from Google Docs to Figma to Github and Dropbox. Clew wants to be the company that helps you streamline all your different cloud-based applications into a single-stream platform that works as a filing system. So far, Clew has lined up 85 paying customers and charges a $50 annual subscription fee.

Arist: Employee training materials like safety and anti-racism courses are usually videos or slideshows. Arist conducts this same training via interactive text messaging, which they say is faster, more natural for today’s users, and leads to higher completion rates. They already have several big ticket clients and say they will soon be profitable.

Decentro: Continuing the X for India trend that is taking shape in this batch, Decentro wants to build Plaid for India. The company provides an API for banking integrations, like Plaid. That Plaid sold for billions of dollars earlier this year is still on the mind of every sentient VC, so the comparison could prove enticing. Decentro is still small, with around $1 million in gross transaction volume (GTV), and around $7,000 in MRR. Still, with just four customers and 45 more in the pipeline, it’s on a good path.

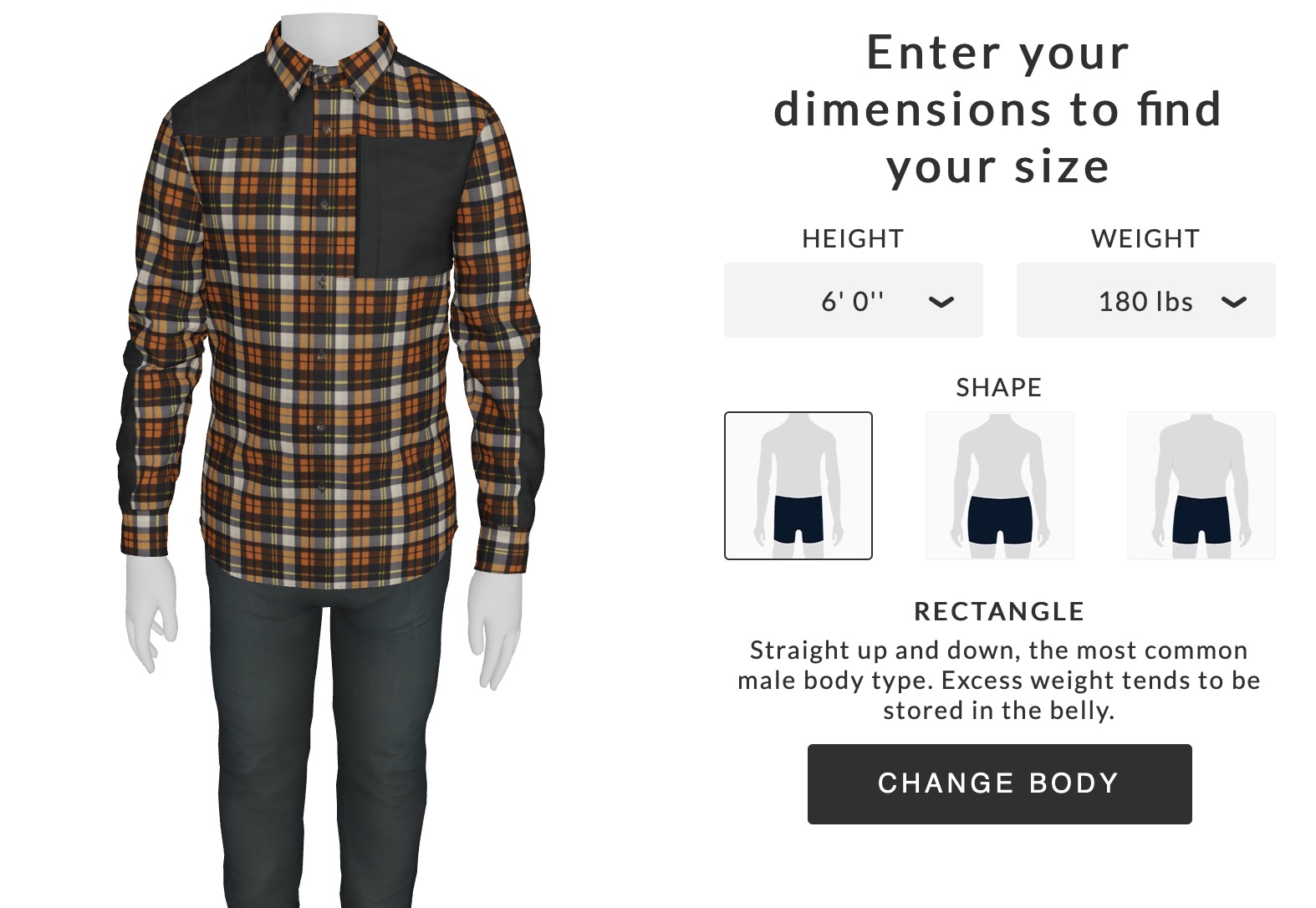

Image Credits: Drapr

Drapr: Drapr is building software to help online shoppers see what their clothing looks like. The company’s online try-on widget helps shoppers get a better idea of how a shirt or other clothing item fits on a customizable 3D mannequin that users can adjust to fit their body type, height and weight.

GitDuck:A video chat tool built specifically for developers. It hooks directly into a developer’s IDE to allow for real-time code sharing, allowing devs to code together remotely. Charges $20 per developer seat.

Hannah Life Technologies: Hannah Life Technologies wants to help couples struggling to get pregnant conceive at home without ever visiting a clinic. The startup sells a small device that can be used during sex which they say can triple the chance of conception. They expect the product to launch with FDA clearance next year.

Hellosaurus: With YouTube making monetization of kids’ content more difficult, there are lots of creators looking to take the next step. Hellosaurus has signed a bunch of them to create an interactive video platform for children, who can play with episodes instead of just watching. It’s a crowded market but with HQ Trivia’s former head of product and some solid creators they may be able to slice off a piece of that $3B market.

Jika: Jika wants to help the average Shopify seller do price testing. The startup said during its pitch that the major online retailers have teams of folks working on pricing. Many smaller Shopify sellers do not change their pricing at all. As we’ve seen from Shopify’s recent quarter, the potential market for Jika’s service is pretty big and growing quickly. Still, Jika is a small thing today, with less than $1,000 MRR today. From small seeds, big trees. Let’s see how quickly Jika can grow its footprint in the Shopify seller market.

Minimall: Minimall bills itself as Pinduoduo for Europe and is another commerce startup aiming to provide consumers access to cheaper goods by cutting out retail middlemen. The company kicked off its efforts by building face masks, moving $450k worth of inventory in 3 months.

Hellometer: Uses off-the-shelf cameras to help fast food restaurant owners analyze how quickly customers are being served. Currently in testing in two locations, with letters of intent to test in 300 more.

MedPiper Technologies: By working with medical schools and government, MedPiper has aggregated the largest database of verified doctors and nurses in India. It charges hospitals a monthly subscription to recruit these medical professionals for open vacancies, faster.

Artifact: Everyone has people and events they’d like to preserve forever. Artifact aids in the creation of a “personal podcast” in which a professional interviewer speaks with someone like your grandparents to get their stories on the record so your grandkids can listen to it without hearing your dog bark in the background.

Charityvest: When rich folks give money away, they often use a donor advised fund, or what Charityvest calls a “a 401K or HSA, but for supporting charities.” The startup’s service allows companies to offer donor advised funds to folks in the middle classes, as an employee benefit. The company has rang up $65,000 in ARR ($5,400 in MRR) thus far. Many big companies match employee donations to some degree. Perhaps this is the obvious next step in that particular progression.

Eatable: Building order-ahead functionality into restaurant workflows, allowing them to sidestep pen-and-paper order taking over the phone and streamline operations.

Heron Data:A B2B company meant to help fintech services categorize/label bank transaction data using methods they promise are more accurate and cheaper than existing solutions.

VoloPay: The startup wants to be Brex for South East Asia. VoloPay seeks to bring approvals, bill payments, expenses, and accounting automation all under one roof and with one platform. It streamlines payments through a corporate credit card, and in 3 months users have spent $90,000.

LendTable: Matching company contributions to your 401K is a great way to save money, but folks living paycheck to paycheck can’t afford to lose that income. LendTable provides cash advance loans to cover the cost of financial employee benefits and takes payments in the form of a single profit-share payment down the line. With 30 million employees not taking advantage of this investment opportunity it could be a big market.

Zuddl: Zuddl is a startup that aims to bring conferences online for big companies. It charges $5 per attendees, and per its pitch has already managed to host a conference with a few thousand attendees. A bit like competitors Hopin and others, Zuddle wants to re-create some familiar in-person scenarios like booths, and lobbies for chatting. Zuddl stands out for racking up $54,000 in revenue in about a month, which, annualized, makes it one of the larger startups demoing.

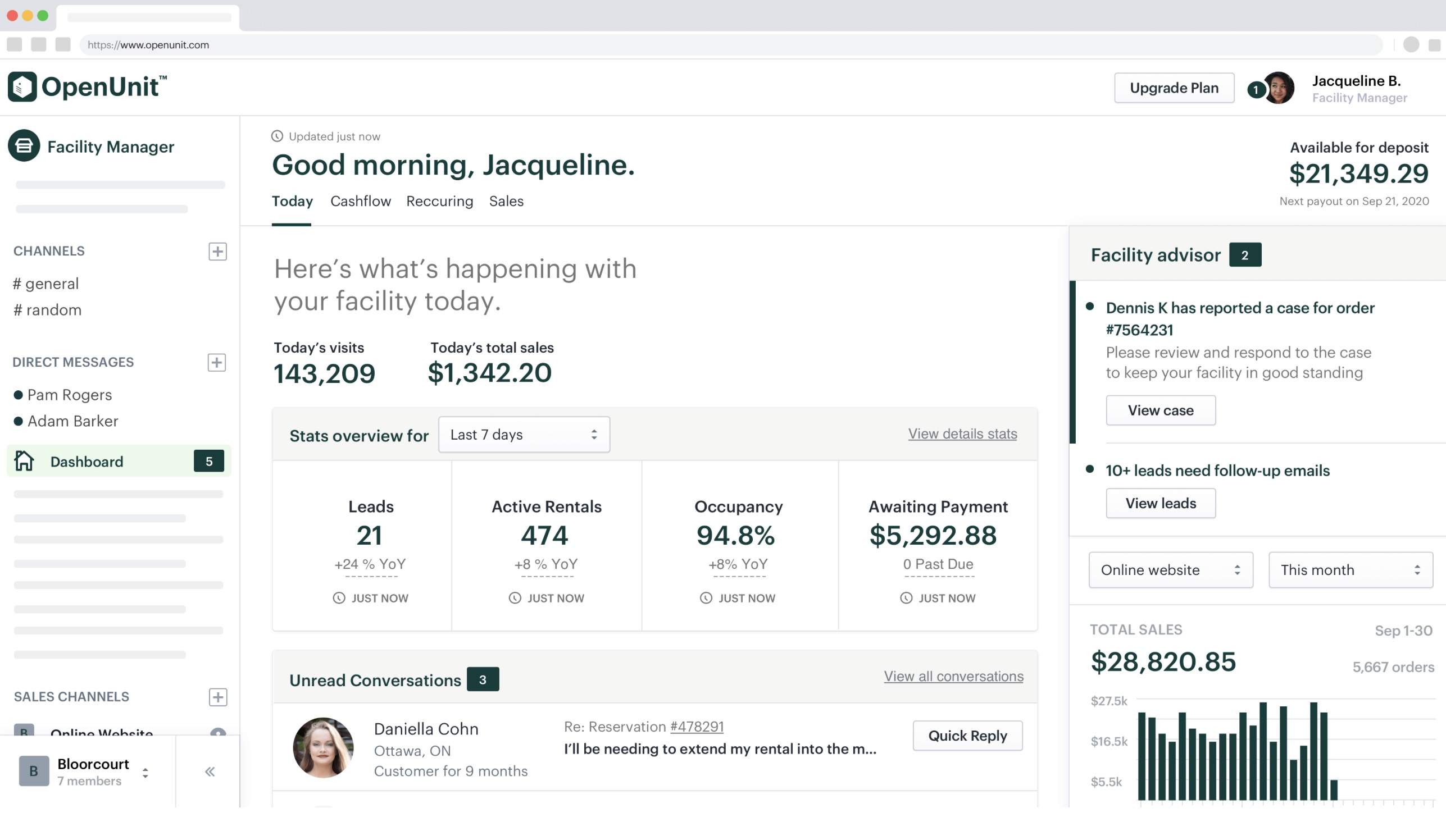

Image Credits: OpenUnit

OpenUnit: OpenUnit is building management software to help self-storage facilities keep an eye on payments and customer accounts. The back office software suite is designed for self-storage facilities of all sizes and is aiming to help provide a highly specified backend that takes care of all the needs these customers have. Here’s our previous coverage.

Ready: Building tools meant to help local ISPs compete with the big nationwide chains, and allow them to cross sell services (like TV or VoIP) from vetted providers to their customers as bundles. Currently working with 5 ISPs with an MRR of $20.5k.

Hubble: Instead of manually tracking data quality, what if software could automatically do that for you? Hubble monitors a company’s data warehouse for errors and missing information, letting in-house engineers focus their time on other tasks. The company launched 3 weeks ago and has three customers. It plans to charge $10,000 per team per year.

OrangeHealth: There are hundreds of thousands of individual doctors with small clinics in India that aren’t set up for online consultations and other telemedicine services. OrangeHealth aims to set them up with the ability to provide online services and billing, as well as delivery and other infrastructure. Customers can keep their local doctor but get quick turnaround online treatments at no extra cost.

DraftWise: Legal work is slow, tedious, and expensive. So, perhaps software can help. That’s what DraftWise wants to do, saying that its service can cut the time needed for a credit agreement from 30 hours to 10. The startup has yet to monetize, but it has nearly a half-dozen letters of intent with some law firms, each it expects to drive seven-figure revenue in time. Indeed, the firm expects to charge big law firms over half a million dollars every year for its service. DraftWise is founded by a lawyer and a few ex-Palantir folks, which sounds fine, provided that they can keep their costs in check. (Hey-o, a Palantir IPO joke!)

Sakneen: Sakneen is another startup aiming to take a model that’s been successful stateside and see how the model fairs internationally. The company is aiming to create Zillow for Egypt and has already built out a database that accounts for 80% of the country’s new housing supply.

SockSoho: A direct-to-consumer clothing company that says it wants to be the “UNIQLO of India”, currently focusing specifically on men’s dress socks. With the majority of their orders taking place over WhatsApp, founder Simarpreet Singh says the company is seeing an MRR of $150K with margins of 70%.

HumanLoop: Building software to annotate, train, and deploy natural language processing atop thorny data sets. The startup is bringing specialized AI to lawyers, doctors, and accountants to process their data, which otherwise would need to be out-sourced to pricey domain experts.

BanditML: The team behind everyone’s favorite algorithm, surge pricing on Uber, is back to bring those ML chops to other companies. This time they’re optimizing when and how to send promotions to customers, and helped send out nearly a million dollars in promos just this month.

Image Credits: Statiq

Statiq: The company allows individuals and buildings to provide EV-charging points, all accessible via a single unified app. So far it appears to be working, with Statiq seeing 500 weekly charging sessions, or about 70 per day. Its weekly pace is growing by about 10% weekly it says, which is pretty good. Its margins are unclear, but the firm did claim $12,000 in net revenue in the last week. So, a little over $2 per charge, if we can divide accurately. Statiq wrapped by saying that Indian government policies are going to push more EV charging points into the market. Perfect, say, for a startup looking to bring folks to them. We covered Statiq here.

Rally:During the pandemic, Zoom has turned out to be a necessary tool for web users trying to stay in touch with friends. Zoom was built for enterprise; Rally is aiming to create a video chat platform built for social gatherings. The app has shifted the idea of a breakout room, aiming to replicate the experience of sparking up side conversations by allowing you to faintly overhear some of the conversation happening “nearby”.

Jemi: A platform meant to help content creators sell experiences (they mention video calls/shoutouts) and merch to their fans. Currently taking a 15% cut of transactions, the team says they’re currently seeing a GMV of ~$17,000 and growing 30% week-over-week.

In Stock: As the coronavirus pandemic keeps local retail stores shuttered, In Stock wants to bring delivery services that don’t just compete, but beat, Amazon Prime. The startup helps retail stores offer same-day delivery, at a cheaper price than Amazon Prime. After launching 6 weeks ago in Santa Cruz, In Stock has positive unit economics. In Stock is currently doing 10 orders per day, and per founder Ian McHenry, it is not scared of Amazon.

KeyDB: A NoSQL database that the team says is “up to 5x faster” than Redis. The company notes that it’s currently seeing over 40,000 downloads per month, and named HP Enterprise as an early customer.

Kingdom Supercultures: Microbes, invented thousands of years, power beer, cheese, kombucha, and wine. But what if they were built in 2020? Kingdom Supercultures has engineered new microbes with the goal of helping national food brands create foods that have never existed before. The startup is licensing its technology to brands focused on healthy and sustainable food development.

OpenBiome: “We’re like a blood bank, but for poop.” It doesn’t get much more straightforward than that! Fecal transplants help cure certain infections by restoring the balance of bacteria in the body; OpenBiome is the largest provider of transplants in the world, having treated 55,000 patients and saved perhaps thousands of lives. They’re a sustainable nonprofit with $15M in revenue and are hoping to expand to new treatments.

MilkRun: MilkRun is a service that connects folks in a city to local food products, like dairy and produce. It scaled to $425,000 in GMV per month in Portland before setting its sights on Seattle. In the more northern rainy city, MilkRun racked up $62,000 MRR in its first six weeks. Echoing the famous Amazon threat that “your margin is my opportunity,” MilkRun said that most money spent on food today goes to packaging and distribution, and that “that inefficiency is [its] opportunity.”

Thndr: Thndr is aiming to build a Robinhood for the Middle East, helping users invest in stock, bonds and funds commission-free via the company’s free app. Robinhood has taken the US exchanges by storm, but the trend hasn’t hit investors in the Middle East; Thndr is aiming to replicate their success with investors there.

Mesh: A “social network for remote companies”, allowing employees to share what they’re working on, see each other’s progress, and share feedback. It’s currently free for teams with fewer than 10 employees, with plans starting at $5 per employee per month after that. Working with 8 enterprise pilots.

KiteKRAFT: KiteKRAFT builds flying wind turbines, with the goal of creating a more viable wind power system for businesses. The startup claims that its wind turbine uses 10 times less material at half the cost of traditional options, and has already flown a 7-foot wide prototype. KiteKRAFT’s first use case is micro-grids, small energy networks that are normally powered by diesel generators and/or solar energy.

kSense: Companies need to collect lots of data in-house but often need to work with a third party to do so. That’s not always practical, as these CTOs found out in their own companies – so they built this tool to perform data collection internally using an open source core.

Blissway: Paying tolls sucks and stopping to pay tolls sucks even more, so Blissway wants to take the process of paying tolls in the United States and make it better. In its view, the current setup of toll-paying is 90% hardware, and 10% software. It wants to flip that with a solution they say can be deployed on “any highway around the world in months”, with the company handling everything from the tolling hardware to customer billing.

Gilgamesh Pharmaceuticals: Gilgamesh is a medtech company aiming to use psychedelic-related drugs to treat a variety of ailments including ADHD and mood disorders, opioid disorders and depression.

inSoma Bio: A biomaterials company focusing on a gel that helps plastic surgeons “rebuild fat” in surgeries such as breast reconstruction. The company says that their gel can double fat volume, potentially replacing the need for implants.

Future Fields: Cellular agriculture, the science that powers lab-grown meat and other meat alternatives, often struggles to get into consumer homes due to a high cost of production. Future Fields sells cell-growth media products that are more cost effective and scalable than the status quo set forward by commercialized agriculture.

Flat: Flat is flipping homes in Latin America: Buy low, fix it up, sell high. It’s a proven model but in LatAm it’s twice as profitable, founders claim. In addition to being the “Opendoor for Mexico,” Flat has the backing of that company’s founders and a $25M debt line secured to scale up.

Layer: A developer tool that creates staging environments quickly so that developers can immediately see/compare/share the impact of code changes. The startup notes that its service allows developers at smaller companies to have access to a similar workflow as the major tech companies of the world. Per the startup, 18 customers have used its service 6,000 times in the last 30 days.

Lume Health: Lume Health is building a Glassdoor for hospitals, aiming to help nurses make the right choice when searching for jobs. The company integrated the predictable aspects of a jobs board, while also building out a platform of verified reviews from nurses that can speak to what an office or hospital was really like from the inside.

MarketForce 360: Salesforce for retail distribution in Africa. The startup brings more clarity to retail transactions in real-time, a mobile solution to pen and paper tracking. Along with a SaaS fee, MarketForce 360 charges a transaction fee on all orders processed over the platform. It has 40 paying fast-moving consumer good companies to date.

Manycore: Companies produce lots of code that runs on cloud computing resources… but if that code isn’t efficient, it racks up costs correspondingly. Manycore takes final code — first Java, and soon Python and JS, and optimizes it for cloud deployment.

Aquarium Learning: A few ex-Cruise folks have built Aquarium Learning to help customer machine learning teams make their models better by improving their datasets. How that happens was not noted, but the firm did claim that after a few months in the market that it has reached $8,000 in monthly revenue, which is nearly a six-figure run rate. Anyway, ML is only becoming more important which means that there are only more datasets in use that probably suck. Someone is going to build a big company here. Perhaps it’s Aquarium Learning.

Strive School: Strive School is building a Lambda School for Europe, leveraging income-share agreements to train software engineers who don’t pay for the education until they get a job in the industry. Once a graduate lands a role, the ISA terms charge the person 10% of salary for four years with a maximum total of €18,000. Read our coverage here.

Image Credits: Kuleana

Kuleana: Aiming to be the “Impossible Foods of seafood”, they’re making a plant-based raw tuna replacement. Currently has $400k in letters-of-intent.

Once: A Shopify storefront optimized for mobile. The startup is trying to funnel e-commerce traffic into mobile purchases, which is not currently as seamless as the desktop experience. By using Instagram stories, Once has created 12 mobile storefronts. The flagship customer has increased conversation rate by 70 percent.

Justo: In Latin America as in the rest of the world, restaurants are working with delivery services to serve quarantining customers. But the apps often take large cuts and hold customer data hostage. Justo aims to provide custom-built e-commerce websites for restaurant brands and provide order and delivery for a maximum 15 percent take — plus the owners get to keep the precious data accrued from the service.

Glimpse: Glimpse helps consumer brands place products in Airbnbs that are part of the Glimpse network. Glimpse gets paid by the brands, and the brands themselves get to put their goods in front, or in the hands of consumers in the market today. If folks who rent Airbnbs are your jam, then Glimpse might be a good alternative to retail. How inventory is managed and so forth wasn’t mentioned, but if Airbnb is on the way back up, perhaps it’s a good moment for Glimpse to unify the house-sharing and consumer D2C boom into a single experience.

Revel Technologies: Aiming to make a “better caffeine” called Paraxanthine. Founder Jeffrey Dietrich (a BioEngeering PhD) says that double-blind tests have shown Revel’s caffeine alternative increases alertness without the jitters/anxiety.

Omni: Helps sales and support teams get up-to-date and accurate answers for their customers. While a rep is on a call, Omni searches across tools to answer customer questions and confirm if information is accurate and up to date. Think of it as a smarter way to answer burning questions, without having to mine through old Slack conversations for the latest updated information. After launching two months ago, Omni has landed $80,000 in pilot programs from Dave, Notion, and Parsable.

Mailwarm: The founders of Mailwarm in their previous companies used email as their main line of communication with customers, but found that even “legit” marketing emails were relegated to the spam folder 20 percent of the time. Mailwarm is the tool they developed to prevent this from happening, and they’re seeing big organic growth and $50K in MRR after just a few months online.

Papercups: On the heels of news that Intercom has hired a CFO and is going to go public in a few years, Papercups wants to sneak up behind the company and pull its sweater over its head while nicking its wallet. In short, Papercups is building an “open-core” piece of software that may be able to challenge the chat portion of the Intercom product set. Sans revenue, the startup flexed 1,500 GitHub stars. Towards the end of its pitch, Papercups said that it intends to charge $50,000 to $250,000 for an enterprise-version of its product in time. We know that Intercom works, so let’s see what Papercups can do in its shadow.

Atmos: Atmos is building a managed marketplace for homebuilding, connecting users that want to build a house with builders who can help them do just that and the financing to make it happen. Since launching in Q2, the company has brought in more than $500k in booked revenue.

Image Credits: StartPlaying

StartPlaying.Games: A marketplace for hiring hosts for social tabletop games like Dungeons and Dragons. DMs for Hire! Meant to help new players learn to play, or help existing players find experienced hosts. Hosts set their own price. Currently seeing a GMV of over $10k per month.

Together Video Chat:For kids, Facetime and Zoom might not be the most engaging way to communicate. Together Video Chat wants to bring an interactive element to video chatting between families and kids, like reading a book or playing games over the screen. The startup is making $17,000 in monthly recurring revenue.

Reach.live: Lifestyle creators looking to monetize live content like yoga or cooking classes often have to resort to multiple platforms. Reach.live aims to put all of them together: storefront, scheduling, payments, subscriptions, donations, and even the video hosting.

Toolbox: An application and labor marketplace that connects general contractors on construction sites with qualified laborers. The service is currently live in New York City and drove $88,000 in GMV in July, a figure that it expects to rise to $102,000 in GMV in August. Toolbox can help some workers find full-time jobs, or plug in shorter work to fill demand gaps. And, Toolbox thinks that it can snag 25% of the total spend. That’s a big take.

Fig: Fig is building an app store for the terminal that allows developers to access lightweight graphical interfaces for common integrations without leaving terminal. These integrations can be further dialed in by the startup’s Teams product that allows engineerings teams to quickly access internal tools and share workflows.

Perch: Pitching itself as “Credit Karma for the underbanked”, Perch helps users build their credit score by turning recurring payments (like rent) into credit payments. The team says they currently have 22,000 users on the waitlist.

SiPhox: A circuit board for optical chips. The startup wants to replace refrigerator-sized diagnostic machines with a tiny chip. It’s first product is a $1 COVID test on a disposable cartridge.

Vectrix: As companies grow, they constantly accrue cloud services and other tools, and with them the possibility of security problems among and between them. Normally the company’s own security engineers would develop their own methods of scanning and monitoring for security issues, but Vectrix provides a marketplace for these processes so they can be set up faster and easier.

Recurrency: This startup is building an “automated” ERP, or enterprise resource planning service, for wholesalers. So far it appears to be working, with Recurrency growing from $0 to $17,000 in MRR during its time at Y Combinator. Per its quick talk, the company has found hundreds of thousands of potential customers.

Known Medicine: Known Medicine is looking to take the experimentation of how tumors respond to cancer drugs out of the patient’s body and into the lab. The startup breaks down tumor samples into micro tumors, which they treat separately inside specialized micro-environments with different methods and see what works best.

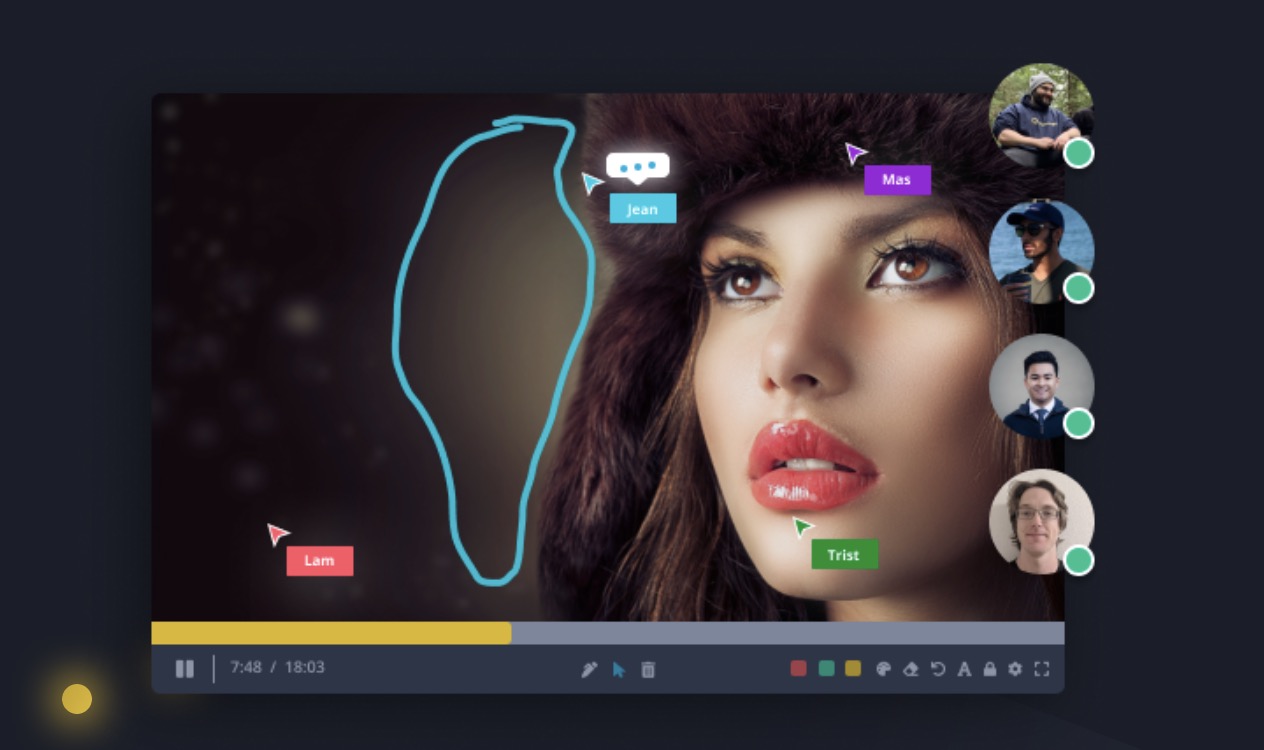

Queue: Real-time collaboration and feedback software for video producers and editors. Allows groups to drop feedback and timestamped comments into the video timeline, or draw notes/concepts directly on the video.

Conta Simples: A digital bank account for startups based in Brazil. The startup helps other online businesses get corporate cards fast and without big fees. Last month, the startup made $50,000 in revenue. The founding team hails from various payments and fintech businesses in Brazil.

Vitable Health: Workers earning living wages often don’t have healthcare options from their employer, and Vitable aims to change that with a plan that costs a tenth of others but still offers primary and urgent care coverage. It relies on nurse practitioners performing telehealth and in home visits, and has catastrophic coverage for emergencies — and costs $50 per month. They’re profitable and small but growing in the Philadelphia area.

ZipSchool: Every parent is worried about their kid’s education this year and the amount of time that those same children are spending on screens. ZipSchool — one of the hotter companies that demoed today, we’re told — is homeschool for kids, on screens, via Zoom. So, it’s screen time, but useful. Its site notes topics that kids might find engaging like art, space, and extreme weather. It’s 2020 and a pandemic and a recession and parents have had to park kidlets with tablets on couches. Why not make that time a bit more constructive?

Minimum: Minimum is another app building a toolset that automatically tracks and offsets a person’s carbon emissions. Minimum is looking to partner with companies directly to help employees stay mindful. It’s a familiar model that pairs a calculator with payments to offset a person’s carbon footprint with Minimum taking 20% off the top.

Image Credits: Sidekick

Sidekick: Standalone, “always-on” video chat hardware meant to help remote teams keep in touch. Charges $50 per user per month. We covered Sidekick here.

Ribbon:Ribbon gives creators and businesses a way to sell tickets for online virtual events, ranging from master classes to fitness workouts. Ribbon has sold $47,000 in tickets sold last week alone, with a 2.8% take rate.

Sameplan: According to Sameplan’s founders, sales reps are basically project managers, but lack the tools PMs usually use to do the job. Sameplan aims to help sales teams share and synchronize data between deals and projects in an organized way, replacing endless email threads and spreadsheets. Heap, Okta and Front have bit for the alpha.

Workbase: A data visualization and analytics tool for account/growth teams, meant to “help B2B companies reduce churn and grow customer spending”. They currently have 3 contracts after launching in May 2020.

Nototo: Nototo is building a visual map interface for note-taking, bringing a very unique interface to a productivity vertical known for its innovative app designs. The app basically encourages users to organize their maps geographically rather than sticking them in nested bullet points and folders.

Plunzo: Helps SMBs in Latin America bring all of their bank accounts into a single UI. The company’s founders say that after launching in early august, they’re already working with over 3,000 retail accounts.

Tella:Tella is building a way to collaboratively edit video from a browser-based application. The startup, which was founded in May, wants to compete with Quicktime and Loom with an easier-to-use edit platform. It helps you piece together video clips from screen and camera recordings, currently sporting 100 weekly users.

Mozart Data: Everything is SaaS now, which means companies may have their data spread over half a dozen tools from Salesforce, Stripe, and so on. Mozart Data collects, organizes, and manages all that data in one place, with no data engineering skills required, in about an hour. The team previously built data tools for companies like Yammer, Clover, Opendoor and others and hope to bring that expertise to growing enterprises looking to scale fast.