Would you like to work with private equity and venture capital funds?

There are relatively few jobs directly inside private equity and venture capital funds, and those jobs are highly competitive. However, there are many other ways you can work and earn money within the industry — as a consultant, an interim executive, a board member, a deal executive partnering to buy a company, an executive in residence or as an entrepreneur in residence.

Venture capitalists often have an operations background. However, historically most private equity professionals were former investment bankers and other finance professionals. Then private equity players gradually realized that value cannot be created through financial engineering alone. A BCG study of 121 investments found that operational improvement drives 48% of value creation in PE-backed companies. PE funds now almost always require an upgrade in management and change management teams if necessary.

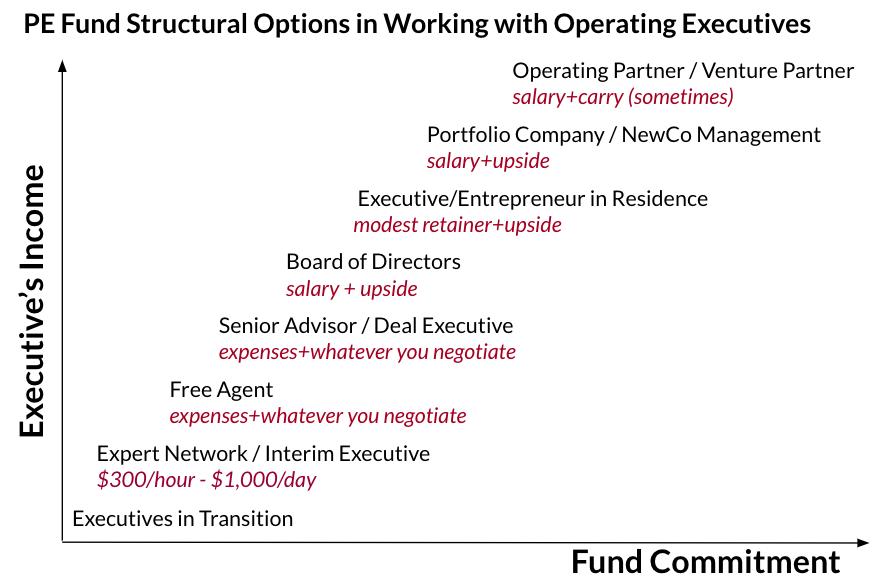

Not surprisingly, the tighter your relationship with the firm, the more money you will earn:

Image Credits: David Teten

At Versatile VC, we’ve used all these models. We are soon launching Founders’ Next Move, a selective, free community for founders researching their next move, which will be a key tool for working with outside talent.

The simplest path forward is to identify funds in your industry of expertise and reach out. You can explore all of the models below with them. First, start by identifying the firms that invest in companies that you’ve worked with. Then, more broadly, look for investors in the industries in which you have expertise. You can identify institutional investors through one of multiple online databases:

| All investors | Private equity | Venture capital |

| Preqin (free demo)

Grey House (free demo) |

PitchBook (free trial)

PrivateEquityFirms.com |

AngelList (free)

CrunchBase (free) PWC MoneyTree (free) VentureDeal (free trial) Asian Venture Capital Journal (free trial) |

Let’s take a look at the different ways you can work with the investment community.

Expert networks

Expert network firms source subject matter experts from various domains and pair them with clients seeking topical or industry insights. They typically charge clients up to $1,200 per hour, and pay the expert $100 to $500 an hour. I founded Circle of Experts, an expert network that I sold to Evalueserve.

The expert network industry has grown an average 4.5% annually between 2015 and 2020, its market size topping $1.3 billion in 2020. While the major clients were initially hedge funds and private equity firms, consulting firms now comprise 32% of total demand for expert network services.

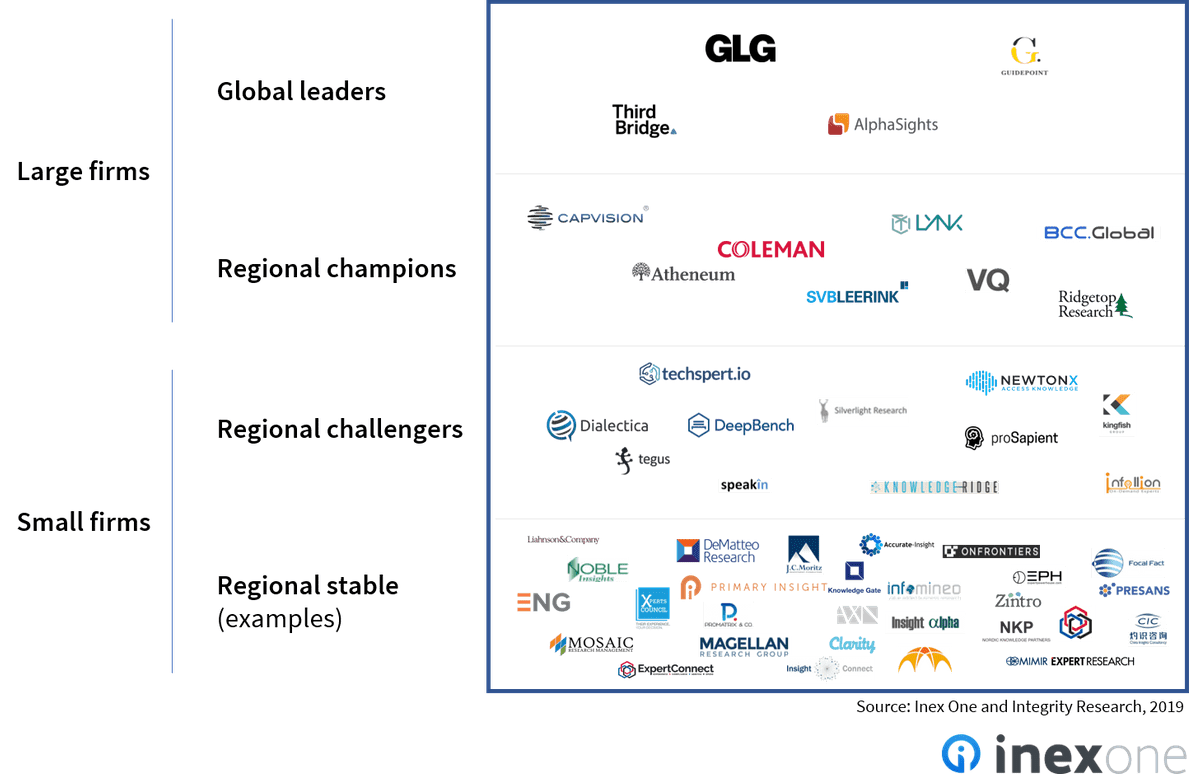

Inex One, an expert network marketplace, has compiled a list of 80 expert networks, summarized in the graphic below:

Image Credits: Inex One and Integrity Research

The largest expert networks include: GLG, which accounts for approximately 50% of the industry’s revenue; AlphaSights is the second biggest generalist expert network; Guidepoint services six major categories of clients globally across several industries; and Third Bridge hires and retains talent to “democratize the world’s human insights and upend the traditional research model.”

Other notable expert networks include Atheneum Partners, Coleman Research Group, Dialectica, ENG, Lynk Global, Mosaic, PreScouter, ProSapient and Tegus. There are also expert networks with sector or geography specialization. For example, SERMO is a global social media network for physicians to exchange knowledge and share challenging patient cases, and Clarity.fm connects startups to experts in building new businesses.