The open banking trend is being driven by a number of factors and will ultimately become the norm. That means retail banks need to rethink their business and operational models if they want to maintain the positions of dominance in the financial ecosystem.

In this report, BI Intelligence explores the drivers behind open banking in detail, outline the options for banks as they look to update their business and operational models, and explain the likely potential winners and losers of open banking.

Here are some of the key takeaways from the report:

- Open banking is most often facilitated by a technology known as Application Program Interfaces (APIs) which have enabled the business models and success of some of the most well known startups of recent times.

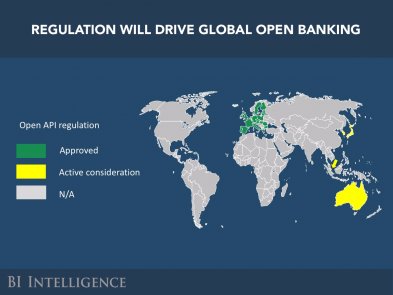

- There are a number of drivers behind the open banking trend, the most obvious of which is regulation that forces banks to give customers access to their data, or enable permissioned third parties to access their data.

- Banks adopting open banking are taking a number of different approaches, from just taking the necessary steps to comply with regulation, to actively embracing the concept in an effort to maintain their retail banking dominance.

- Banks are using different models of open banking, including app stores and sandboxes. Which model, or combination of models, a bank adopts depends on its priorities and the drivers it finds most imperative.

- Open banking will have a significant impact on fintechs. With access to banks’ systems and vast data stores, fintechs will be able to provide more personalized products, while operating with greater autonomy. However, open banking will also increase fintechs’ regulatory and cybersecurity burdens.

In full, the report:

- Explains the concept and mechanics of open banking.

- Outlines the drivers behind its increasing adoption by global retail banks.

- Highlights the different approaches banks are taking to open banking, and explores the advantages and disadvantages of each.

- Explores the future of open banking, including its impact on fintechs.

Interested in getting the full report? Here are two ways to access it:

- Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>Learn More Now

- Purchase & download the full report from our research store. >> Purchase & Download Now

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends