This story was delivered to BI Intelligence “Fintech Briefing” subscribers. To learn more and subscribe, please click here.

Capital Float, an Indian online lending company that targets small businesses, has raised $25 million in a Series B funding round.

The company has now raised a total of $41 million, and it plans to use these new funds to add 20,000 new customers and to produce new online products.

Capital Float offers short-term loans to small online merchants, typically for a period of 90 to 180 days, along with invoice financing and longer-term loans, typically six months to three years, to all small businesses.

The catch is that online merchants must operate on one of Capital Float’s partner platforms, which include Amazon, eBay, and Paytm. The good news, though, is that online merchants only need to be up and running for one year to apply for a loan, rather than the traditional three-year requirement.

Capital Float could generate more solid data on its online merchants thanks to its e-commerce partners, and this should reduce the risk on the loans.

E-commerce is growing quickly in India, as it hit $16 billion in 2015 and is expected to hit $102 billion by 2020. India also has more than 220 million smartphone users and approximately 540 million adults in the nation, which equates to low smartphone penetration but tremendous potential for e-commerce inside the country’s borders.

The situation for small business loans is much the same in the US. Small businesses represent 99% of US companies, 54% of total sales, and 55% of all jobs, according to the US Small Business Administration.

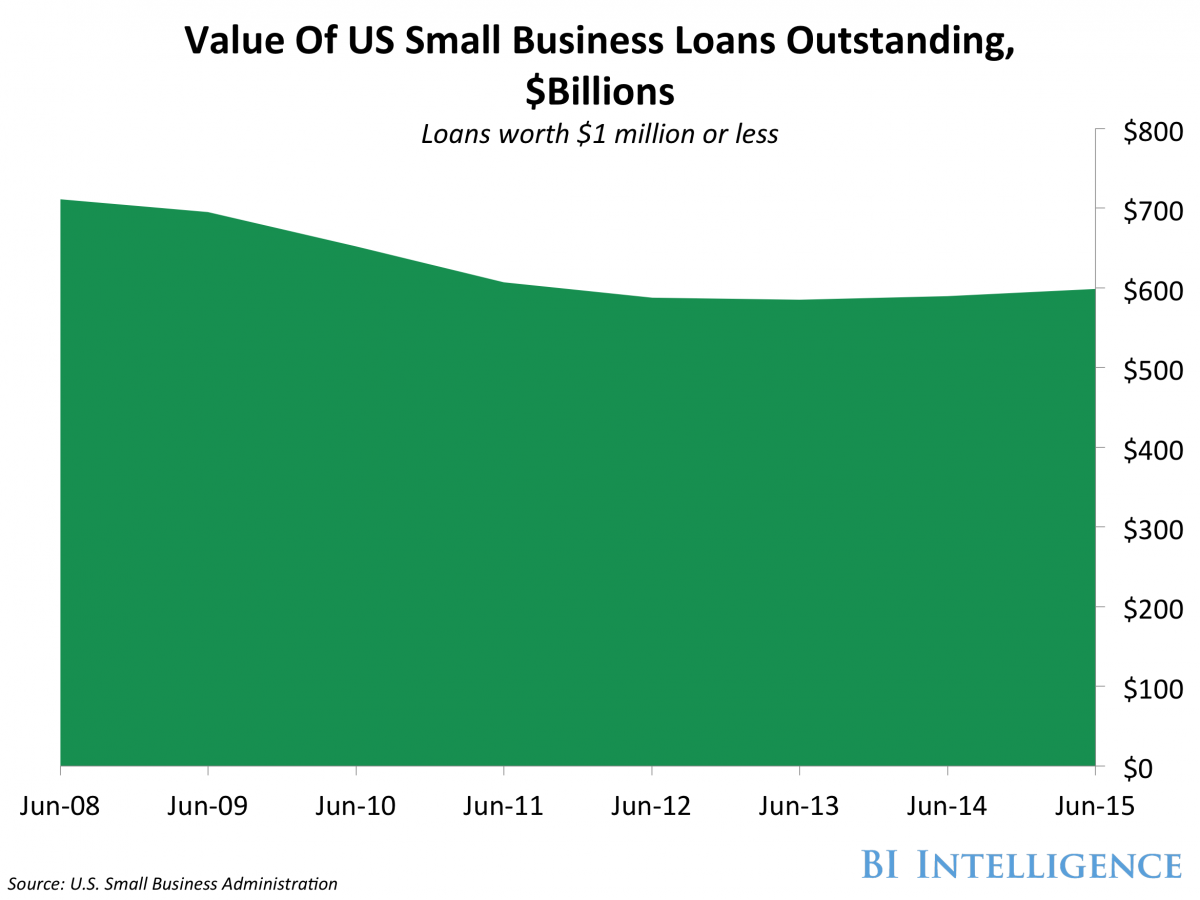

These businesses need capital in order to grow, but small businesses are underfunded — only half of small businesses with $100,000 to $1 million of annual revenue received at least some of the financing they applied for from large banks in late 2015. This is partially because banks have retreated from this segment because issuing loans to small businesses using the traditional underwriting model is expensive. This leaves a massive amount of unfulfilled loans that we estimate reached $96.5 billion in Q4 2015.

Alternative lending companies have stepped in to capitalize on the opportunity available in helping meet more small business’ lending needs.Alternative small business lending platforms use machine learning and digital tools to extend credit to a wide array of small businesses quickly and efficiently, particularly to those that have been rejected by banks. Alternative small business lending companies provide digital platforms that connect small business borrowers to capital using nontraditional means.

We estimate that alternative small business lenders originated $5 billion and had a 4.3% share of the small business lending market in the US in 2015. But alternative small business lending platforms will originate $52 billion and gain a 20.7% share of the total market by 2020, driven by the continued growth of new players, increased borrower awareness and interest, and most importantly, major partnerships with big banks.

Evan Bakker, research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on small business alternative lending that analyzes the market opportunity for alternative lenders, forecasts the market share and volume growth of alternative lending platforms, profiles key players, and addresses the main industry risks.

Here are some key takeaways from the report:

- Alternative lending platforms are in a position to capitalize on this underfunding and also take share from banks. These companies use machine learning and digital tools to extend credit to a wide array of small businesses quickly and efficiently. We estimate that alternative lending companies’ share of the small business lending market in the US will reach 20.7% by 2020.

- Alternative lenders are now partnering with banks and this will propel growth going forward. New lenders are finding opportunities to offer white-label services to major banks. We expect banking partnerships, like the one between JPMorgan and OnDeck, to add 7.7 percentage points to the alternative lending industry’s market share by 2020.

- A flurry of new lenders have entered the market, but it’s still early innings. A handful of small business lenders, from Funding Circle to Credibly, have entered the market and this is creating challenges as customer acquisition costs rise and alternative lending companies struggle to differentiate themselves.

In full, the report:

- Forecasts the market share and volume growth of the small business alternative lending sector, and breaks down the main growth drivers.

- Explains why small businesses are underfunded, and quantifies the market opportunity for alternative lenders.

- Defines the different types of platforms that alternative lenders employ, including their revenue models.

- Lists the advantages and disadvantages that alternative lenders have compared to traditional players.

- Overviews the key players in the industry and identifies their growth factors as well as the pain points limiting their growth.

- Pinpoints the key risks that could undermine the success of alternative platforms

To get your copy of this invaluable guide, choose one of these options:

- Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

- Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of small business alternative lending.