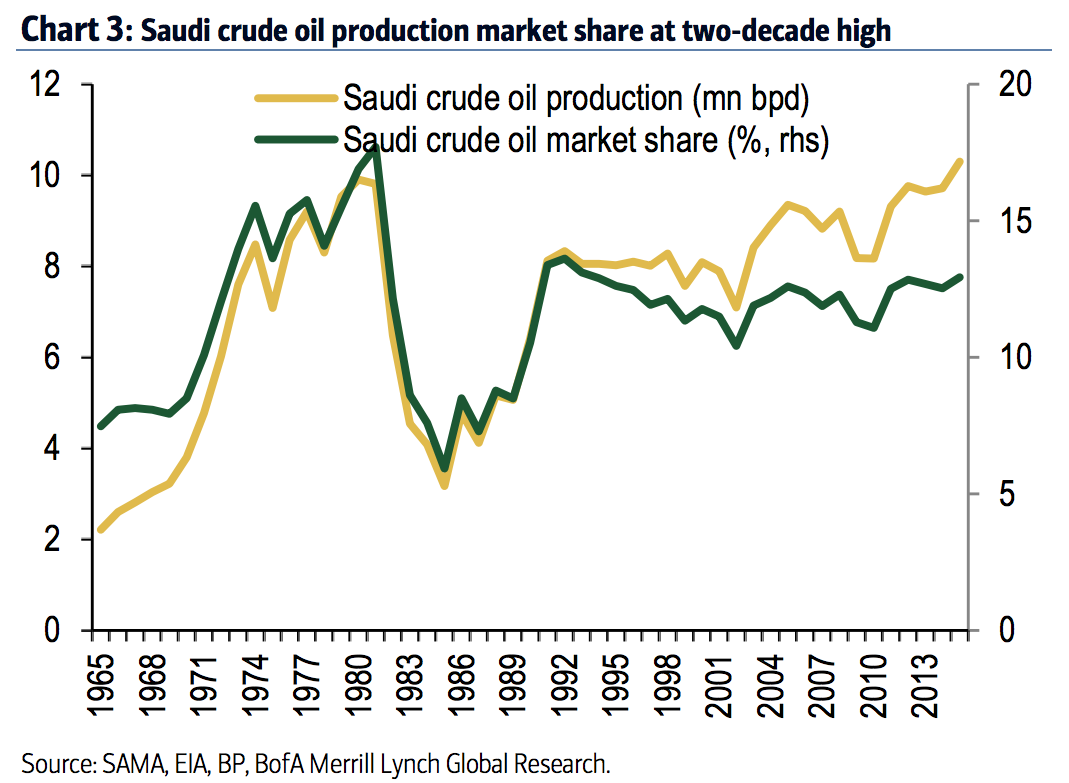

BAMLSaudi Arabia’s oil production has ticked up over last decade as it works to defend its market share.

BAMLSaudi Arabia’s oil production has ticked up over last decade as it works to defend its market share.

Most recently, on Thursday, the Wall Street Journal’s OPEC correspondent Summer Said tweeted: “OPEC is ready to cooperate on a cut, but current prices are already forcing non-opec producers to at least cap output, says UAE Energy min.”

And on Friday crude oil prices were spiking more than 10% on renewed hopes these actions could bring balance to the oversupplied market.

However, a potential coordinated production cut still faces a few major headwinds, Bank of America Merrill Lynch’s Jean-Michel Saliba argued in a recent note.

Chief among them:

- Iran wants to regain market share post-sanctions.

- The decentralized nature of production in Russia and the “difficulty to restore oil production levels in Russia post-cuts.”

- The “possible lack of mutual trust given geopolitical matters.” (Although Saliba does not specify to which geopolitical matters he is referring, possible examples include Saudi Arabia and Iran vying for regional dominance, as well as the situation in Syria).

Notably, Saliba singled out the first detail in particular.

“Until Iran oil export ramp-up is complete, we think OPEC is unlikely to be able to agree on a common policy,” he argues. “As the Iranian oil exports increase could be well underway to completion by end-1H16, the next Ordinary OPEC meeting in June is important to monitor.”

Raheb Homavandi/Reuters

Raheb Homavandi/Reuters

Back in January, Oppenheimer’s James Schumm argued that “though low oil prices hurt Saudi Arabia, they negatively impact Iran in a much greater way and it crimps Iran’s ability to fund sectarian uprisings in Saudi Arabia’s backyard.” Hence, it behooves the Saudis to weather lower prices for longer.

Moreover, Iran’s imminent return to the market inspired a major stress point back at the December OPEC meeting between the Saudis and Iran as the two parties adopted conflicting stances on cutting output, as RBC Capital Markets’ Helima Croft observed.

Interestingly, Saliba also argues that what’s happening today could be similar to what happened back in 1997/1998:

“These developments would bear some resemblance to the situation in 1997/1998, in our view, as Saudi Arabia had led a 10% OPEC supply quota increase in December 1997 in the face of declining demand from Asia. By March 1998, Saudi Arabia had cobbled together a joint cut with non-OPEC producers (primarily Mexico and Venezuela), followed by an OPEC cut in June 1998 and a further OPEC cut in March 1999.”

Although, the “one key difference with that time however is that Saudi Arabia’s balance sheet is much stronger now to sit out the shock as the ensuing oil price rebound in 1999 could have likely saved off Riyadh from a devaluation at the time,” writes Saliba.

“Recall that Fx reserves were low (9.7% of GDP), government debt was high (102% of GDP) and there was a ‘speculative attack’ on SAR with increased domestic dollarization in 1998.”

In any case, the big point here is that even though a coordinated production cut sounds appealing economically, there are all sorts of other factors that could derail it.

NOW WATCH: Watch Trump go head-to-head with a reporter and attack Megyn Kelly for being a ‘lightweight reporter’