The American economy has looked pretty robust of late — unemployment just hit a 16-year low, and stocks recently reached an all-time high.

This makes it all the more curious that Americans have suddenly stopped paying off their credit-card bills at a rapid rate.

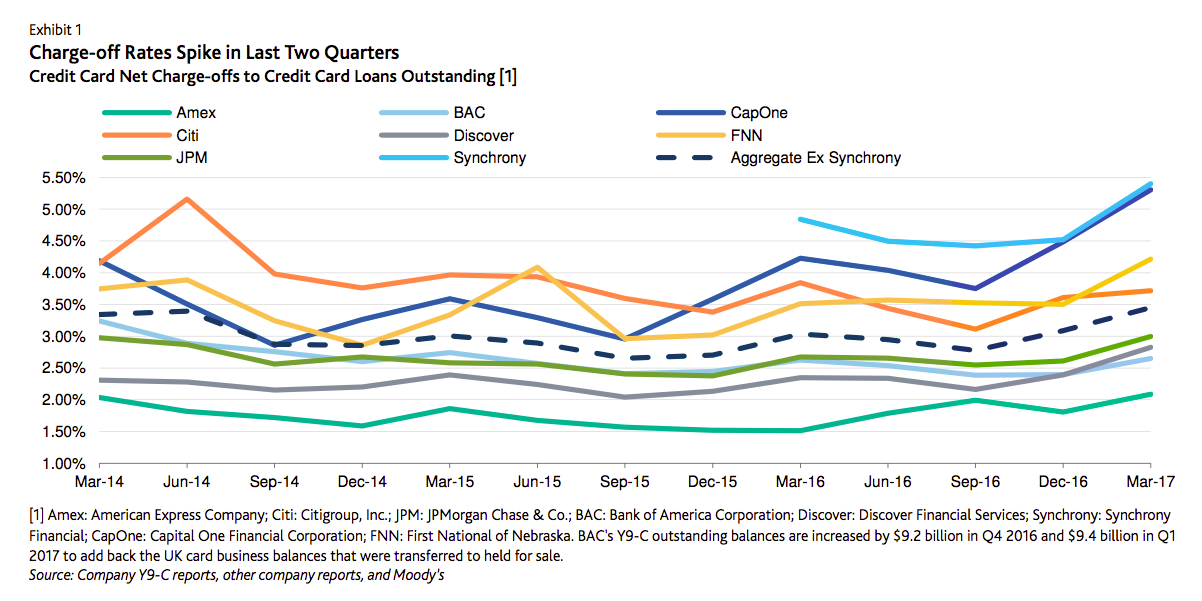

In the past two fiscal quarters, banks reported a steep rise in credit-card charge-offs — debt that companies can’t collect from their customers — according to a report from Moody’s.

This chart from the report shows how each bank has fared on charge-offs, with Capital One, First National of Nebraska, and Synchrony showing the worst performance over the period:

The sharp increase, the largest since 2009, is especially unusual given how strong the US employment market has been, Moody’s noted. It suggests that American consumers haven’t fallen on hard times so much as banks have started to loosen their standards and issue credit more aggressively.

Card issuers have been much stricter since the financial crisis and the passing of the Card Act in 2009, which added an array of protections for consumers. Getting a credit card got a lot tougher, especially if you had subprime credit.

Charge-offs and unemployment tend to be related: When people lose their jobs, credit cards tend to be one of the first bills people stop paying, as compared with loans for a home or a car in which people risk losing those crucial assets.

So, charge-offs spiking when unemployment claims are low indicates that banks have lowered their standards and are approving people for cards who aren’t as creditworthy.

The ratio of charge-offs to unemployment claims had been hovering near all-time lows, but this chart shows that it’s shot back up to the historical average in the past two quarters — meaning standards may have deteriorated “rapidly,” according to Moody’s.

In the bigger picture, charge-offs still remain at pretty low levels. This chart shows that we’re still well below the historical average rate:

But if lending standards continue to degrade, things could get messy in a hurry if the economy takes a turn for the worse, according to Warren Kornfeld, a senior vice president at Moody’s.

“Although card standards were extremely tight in the years following the financial crisis, if underwriting then loosened materially, as the rise in charge-offs suggests, asset quality could continue to deteriorate rapidly going forward, especially in the event of a recession,” Kornfeld said in a statement.