This story was delivered to BI Intelligence “Fintech Briefing” subscribers. To learn more and subscribe, please click here.

IBM has been busy making a name for itself as the go-to blockchain technology provider for trade finance solutions.

That reputation strengthened this week when it was selected by seven European banks to help them build and host a new trade finance platform, the Digital Trade Chain (DTC). The banks — Deutsche Bank, HSBC, Societe Generale, UniCredit, Rabobank, Natixis, and KBC — are all members of the small- and medium-sized business (SMB)-focused Digital Trade Chain Consortium founded in early 2017.

The platform will be based on the IBM Blockchain, built on the Hyperledger Fabric, and hosted on the IBM Cloud — it will go into production by the end of 2017. The goal will be to streamline domestic and cross-border trade for European SMBs by providing them with a holistic overview of trade transactions they participate in. Because all parties will have access to the same record on a decentralized ledger, IBM says, this will boost accountability in the supply chain, reducing risk and boosting access to capital for small businesses. The platform could also reduce administration costs by digitizing and automating the supply chain from order to settlement of a trade.

This could establish IBM as the leading provider of blockchain technology infrastructure for financial services. For blockchain solutions to be truly effective, they need as wide a network of users as possible, so endorsement from such a large number of Europe’s biggest banks makes it seem almost certain that if and when blockchain technology adoption becomes widespread within trade finance, IBM will be the leading, and perhaps sole, supplier of blockchain infrastructure in the space.

If its recent move into the regtech space meets with the same success, IBM could soon find itself with few competitors in its path to become the top blockchain technology provider for the financial services industry.

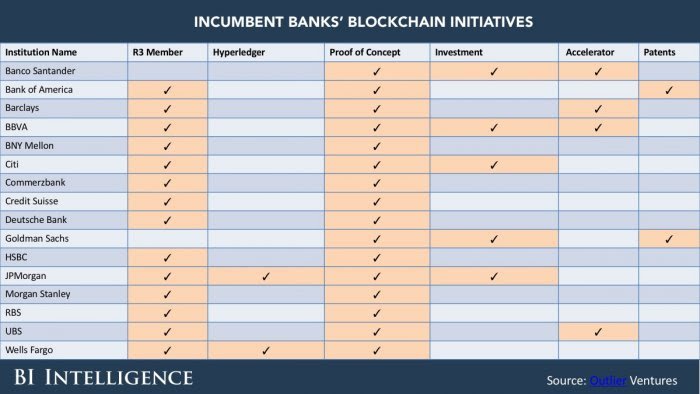

Nearly every global bank is experimenting with blockchain technology as they try to unleash the cost savings and operational efficiencies it promises to deliver.

Banks are exploring the technology in a number of ways, including through partnerships with fintechs, membership in global consortia, and via the building of their own in-house solutions.

Sarah Kocianski, senior research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on blockchain in banking that:

- Outlines banks’ experiments with blockchain technology.

- Details blockchain projects at three major banks — UBS, Credit Suisse, and Banco Santander — based on in-depth interviews.

- Discusses the likely trends that will emerge in the technology over the next several years.

- Highlights the factors that will be critical to the success of banks implementing blockchain-based solutions.

To get the full report, subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and more than 250 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>Learn More Now

You can also purchase and download the full report from our research store.

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends