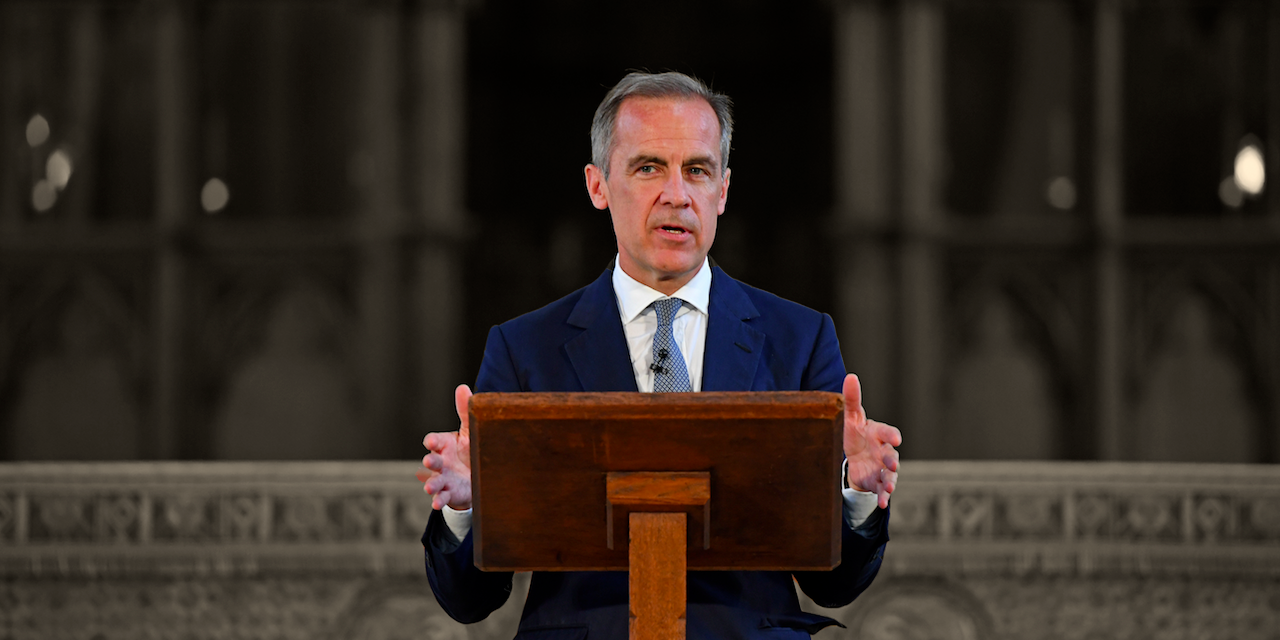

Reuters/Chris J Ratcliffe

Reuters/Chris J Ratcliffe

- Carney says financial services sector could be worth 20 times GDP in 25 years.

- UK GDP currently around £1.9 trillion annually.

- Success of financial services relies on strong regulation post-Brexit.

LONDON — Bank of England Governor Mark Carney says that Britain’s financial services sector could double in size within the next 25 years, so long as Brexit goes to plan.

Speaking to The Guardian newspaper to mark the 10th anniversary of the start of the financial crisis, Carney said that business in the financial services sector could end up being worth “15 to 20 times GDP” — valuing it at roughly £38 trillion at current GDP levels.

UK GDP is around £1.9 trillion annually right now. However, obviously, the economy should grow significantly over the next 25 years, meaning that the City could be worth substantially more than that figure.

“We have a financial system that is ten times the size of this economy … It brings many strengths, it brings a million jobs, it pays 11% of tax revenue, it is the biggest export industry by some token … All good things,” Carney told the Guardian’s Larry Elliott and Jill Treanor.

“If the UK financial system thrives in a post-Brexit world, which is the plan, it will not be 10 times GDP, it will be 15 to 20 times GDP in another quarter of century because we will keep our market share of cross-border capital flows. Well then you really have to hold your nerve and keep the focus,” he added.

There are fears that the City could lose its status as the EU’s financial centre in a post-Brexit world, given the likely loss of the financial passport which allows banks with a base in the UK to sell products and services to customers and financial markets across the EU.

Banks from across the world are currently assessing their options when it comes to Britain’s impending exit from the European Union. Most lenders from Japan and the USA currently have their European bases in London, but are expected to shift those operations to continental Europe to maintain an EU presence after Brexit.

This has sparked fears of a mass exodus from the City.

But success, he told the Guardian, relies on the British government maintaining a strong regulatory framework in the post-Brexit world and not resorting to lowering taxes and cutting red tape to attract business.

“We have a view… that post-Brexit the level of regulation will be at least as high as it currently is and that’s a level that in many cases substantially exceeds international norms,” Carney said.

“There’s a reason for that, because we’re not going to to go the lowest common denominator in a system that is 10 times size of GDP.”

In January, it was reported that Prime Minister Theresa May was ready to turn the UK into a low-tax, low-regulation haven after Brexit after Chancellor Philip Hammond was asked at the weekend by the German newspaper Welt am Sonntagwhether he was willing to turn the UK into “the tax haven of Europe”.

He replied that while he “personally [hopes] we will be able to remain in the mainstream of European economic and social thinking,” EU threats to cut off single market access for the UK meant we may “become something different.”

“I personally hope we will be able to remain in the mainstream of European economic and social thinking. But if we are forced to be something different, then we will have to become something different,” he said.