BI Intelligence

BI IntelligenceThis story was delivered to BI Intelligence “Payments Briefing” subscribers. To learn more and subscribe, please click here.

Although Discover, one of the four major US credit card networks missed on expectations it still posted strong numbers in several key segments for Q2 2017.

Discover saw increases across the board in its loan channels, which includes cards, student, and personal, but it is clearly the card segment that has had the biggest impact.

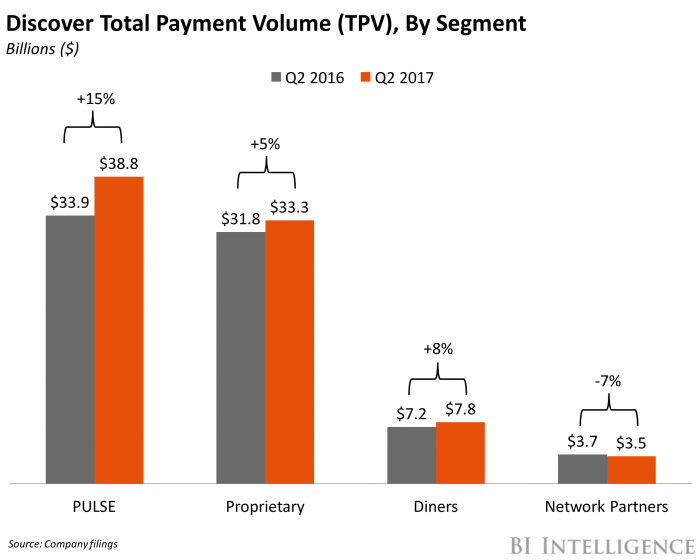

- Card volume grew 8% year-over-year (YoY), which was perfectly in line with the company’s overall growth in payment volume. Card volume, which accounts for $61.8 billion dollars of the $78 billion in loans was led by Discover’s Pulse segment in Q2. Pulse, which is the firm’s debit network, is the fastest growing segment by volume with a 15% increase YoY to reach $38.8 billion. This is significant when considering that this segment had been experiencing consistent declines for some time, but seems to have reversed course thanks to two straight quarters of growth.

- However, Discover must continue to diligently manage its rewards program or risk sacrificing the positive gains from its impressive growth. Discover’s rewards rate was down 1 basis point YoY, which was driven by lower promotional rewards. It’s important to note that the company did state that they are expecting a “modest uptick” for the rest of the year as they begin trying to drive holiday sales. A successful second half of the year could hinge on Discover striking a balance between offering enticing rewards to attract cardholders, but also finding a way to keep costs down.

BI Intelligence, Business Insider’s premium research service, has compiled a detailed credit card rewards explainer that:

- Identifies the costs associated with offering rewards for issuers and how they have increased over time.

- Details why credit card issuers continue offering high-valued rewards.

- Analyzes how the industry has evolved since 2011

- Explores how credit card issuers will advance in order to continue reaping the benefits of offering rewards without assuming increased costs.

To get the full report, subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND more than 250 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> Learn More Now

You can also purchase and download the report from our research store.

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends