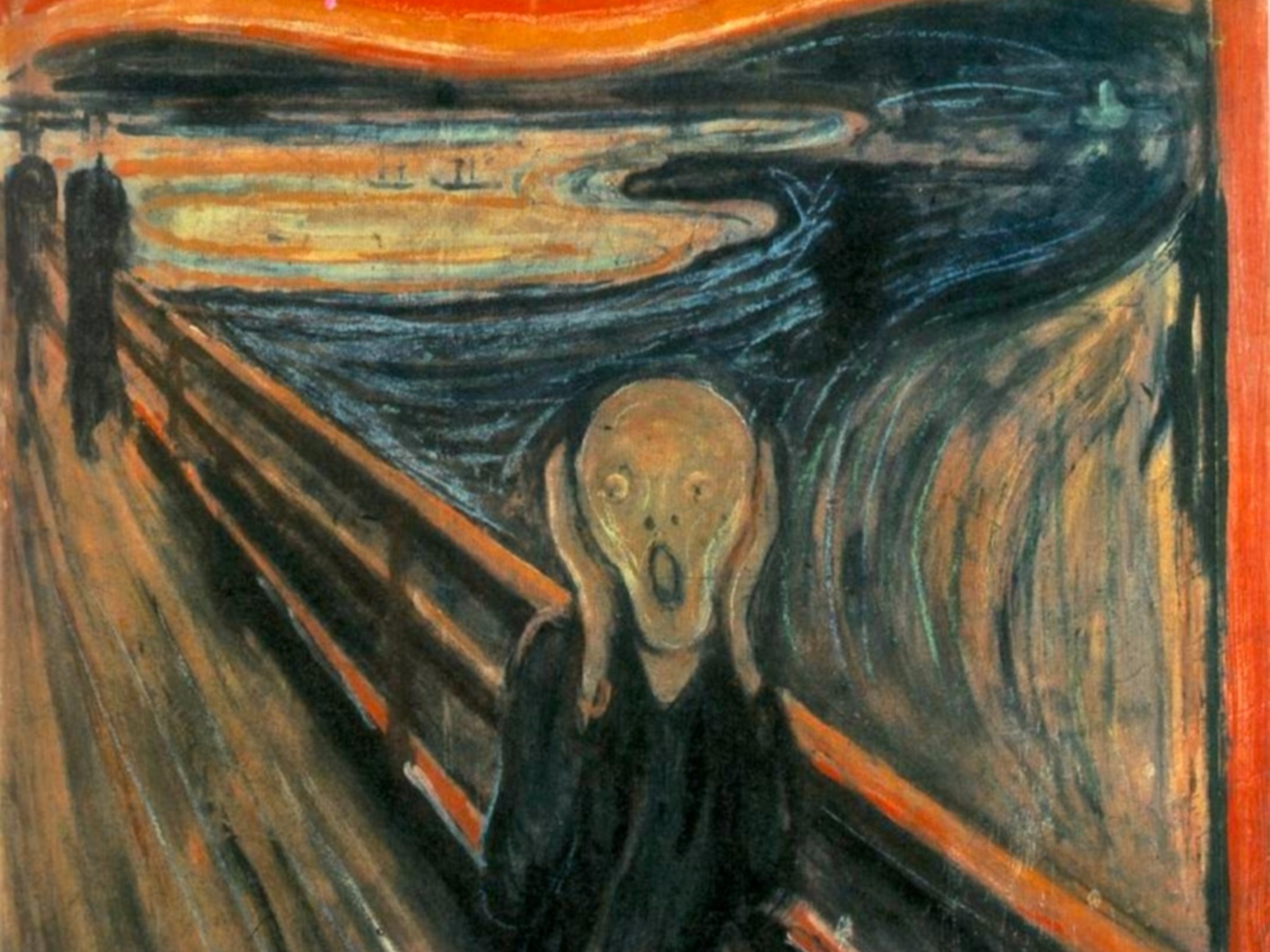

Pictured: A European investor right now.Edvard Munch/Wikimedia Commons (CC)

Pictured: A European investor right now.Edvard Munch/Wikimedia Commons (CC)

LONDON — A year ago, tech investors were playing an anxious game of introspection over frothy market conditions: Are we in a bubble? Are we heading for a crash?

Today, Europe’s venture capitalists are worried for a very different reason: Brexit.

“Everyone is still very nervous,” said Nic Brisbourne, managing partner at London-based Forward Partners.

It is now almost six months since Britain’s shock vote to leave the European Union — but it still feels like it’s almost the only thing anyone wants to talk about. With the UK government still providing little meaningful detail about its actual plans for Brexit (“Brexit means Brexit!”), the tech industry has been left bemoaning the lack of clarity and second-guessing what it will mean for them.

“It’s just an uncertain world out there,” Sonali De Rycker, a partner at venture capital firm Accel Partners said on stage at the TechCrunch Disrupt conference in London on Monday. “There’s no plan A, there’s no plan B, there’s no plan C. The startups do not know … if you want to add 100 engineers in London, you’re pausing on that.”

She added: We’re in ‘deer in headlights mode,’ candidly — we do not have a clue what’s happening.”

It’s little surprise the tech industry is approaching Brexit with trepidation. It overwhelmingly supported remaining part of the European Union prior to the referendum — almost 90% of respondents were pro-Remain in one poll. But now it’s a reality, there are numerous points of concern, from access to funding to the availability of talent.

The tech industry is heavily reliant on skilled immigrant labour — making it acutely vulnerable to changes in British border policy. Stricter controls could see startups and growing businesses unable to bring over enough talent from Europe — or even lose the talent they have, risking making Britain a less attractive hub to found and grow companies.

When London firm Balderton Capital surveyed its portfolio companies about their post-Brexit concerns, the “number one thing that came up was access to talent,” partner James Wise said on stage. Right now, the UK is “the number one nation that people look at for tech roles outside of their home country across Europe.”

Funding is another worry point. A disappointing Brexit deal could make dissuade international venture capital firms from investing in British businesses, and make it harder for the VC firms already here to raise new funds. In particular, the European Investment Fund has provided British firms with €2.3 billion (£1.9 billion) between 2011 and 2015 — and its future in Britain is in question.

Nic Brisbourne, a managing partner at seed stage firm Forward Partners, told Business Insider that a key concern of his is what it will mean for LPs — the people and institutions that provide the capital for venture capital firms. If that dries up, the effects could be widely felt.

Theresa May won’t provide the tech industry with much-desired clarity.Stefan Wermuth/Reuters

Theresa May won’t provide the tech industry with much-desired clarity.Stefan Wermuth/Reuters

“I think [our] portfolio companies are probably not going to be that heavily impacted, but the more worrying bit definitely is what happens to people who invest in VC funds. If they turn away from the UK and we’ve got less money in VC funds, less money to invest in startups and everything — that will be bad news.”

Matt Hancock, the government minister for the digital economy, also spoke at TechCrunch Disrupt, in appearance that was heavy on optimism but light on details. He failed to shed more light on the kind of visa program the UK might operate post-Brexit, or the precise nature of the government’s position in Article 50 negotiations (something Prime Minister Theresa May is steadfastly refusing to disclose). But he did point to a series of recent investment announcements in the UK after the referendum as signs of industry confidence.

Google recommitted to its plans to build a new British HQ and create 3,000 jobs in November, while Facebook has said it would expand its UK presence by 50% in 2017.

“We’re clear that we’ve got to be open and welcoming to the brightest and the best around the world,” Hancock said. “We need to make sure that we’re clearly winning that global war for talent.”

Frederic Court, managing partner of Felix Partners, doesn’t think we’ll see a sudden talent exodus: “Many people here have built lives here.” But that doesn’t mean there won’t be an impact.

“Many people will stay. The main challenge is people will not come, and that’s the point that does not … get any media coverage.” He cited José Neves, the Portuguese-born founder of fashion tech startup Farfetch. Neves might not now leave — but post-Brexit, the next Neves might decide never to move to London in the first place.

The “elephant in the room,” according to French digital minister Axelle Lemaire, is that Brexit is not a purely economic argument. Even if Britain gets everything it asks for in the negotiations, there’s a rising tide of xenophobic nationalism, and the harm may have already been done.

It is “all very well to talk about how do we attract the best talent in London, but will they feel welcomed by the rest of the country?” she asked.

The government refuses to provide clearer details of its Brexit strategy, arguing that doing so would weaken its hand going into negotiations with Europe. But the tech industry fears that this uncertainty has the potential to be damaging — to everything from funding to hiring.

The wildcard: Donald Trump.Ethan Miller/Getty Images

The wildcard: Donald Trump.Ethan Miller/Getty Images

And compounding matters is the extreme uncertainty over what the election of Donald Trump will mean for the European startup ecosystem — and the world at large. Nic Brisbourne sees two very different possibilities. One the one hand, “it increases uncertainty, and that’s a bad thing when you’re asking people to take risky bets, and venture capital is a risky bet.”

However, “you can make the opposite case, which is America gets more risky, therefore people start looking abroad.”

But what if Trump really does pose the existential threat to civilisation that his opponents claimed? The investor is stoic. “If he does we’re all f–ked, so we might as well carry on regardless.”