That isn’t to say that debt doesn’t pose a problem for China. It’s just that it isn’t the usual problem.

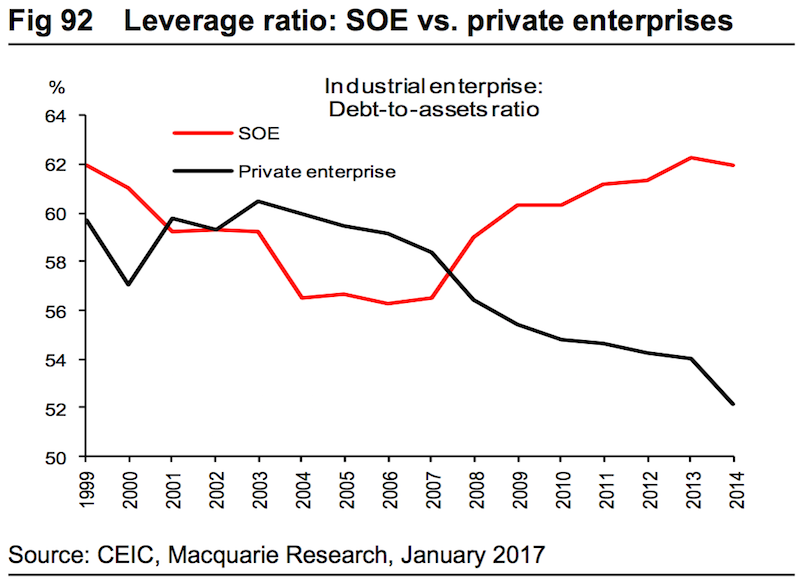

“In our view, the real risk behind China’s debt is capital misallocation, as the majority of creditis poured to the less-efficient SOEs and local governments rather than the private sector,” the analysts noted.

Macquarie Research

Macquarie Research

Instead, the deleterious effects of the debt will likely be felt in the long run in the form of slower growth.

In the words of Macquarie’s Research team, “capital misallocation could undermineChina’s potential growth in the long run,causing the country to become stuck in the so-called ‘middle–income trap'” as unproductive debt does not lead to sustainable economic growth by improving productivity.

“During the Asian Financial Crisis,” the team noted, “the average step-down in gross capital formation to GDP, 1996-98, for Malaysia, Thailand, Indonesia and Korea was approximately 14%.”

Macquarie Research

Macquarie Research

The catalyst of the precipitous decline was “a hard-stop by capital providers, cross-border bank lending.” If something similar were to transpire in China today, they noted, the equivalent “would be a hard-stop of capital provision by the household sector, i.e. bank deposits leaving the Chinese banking systemen masse.”