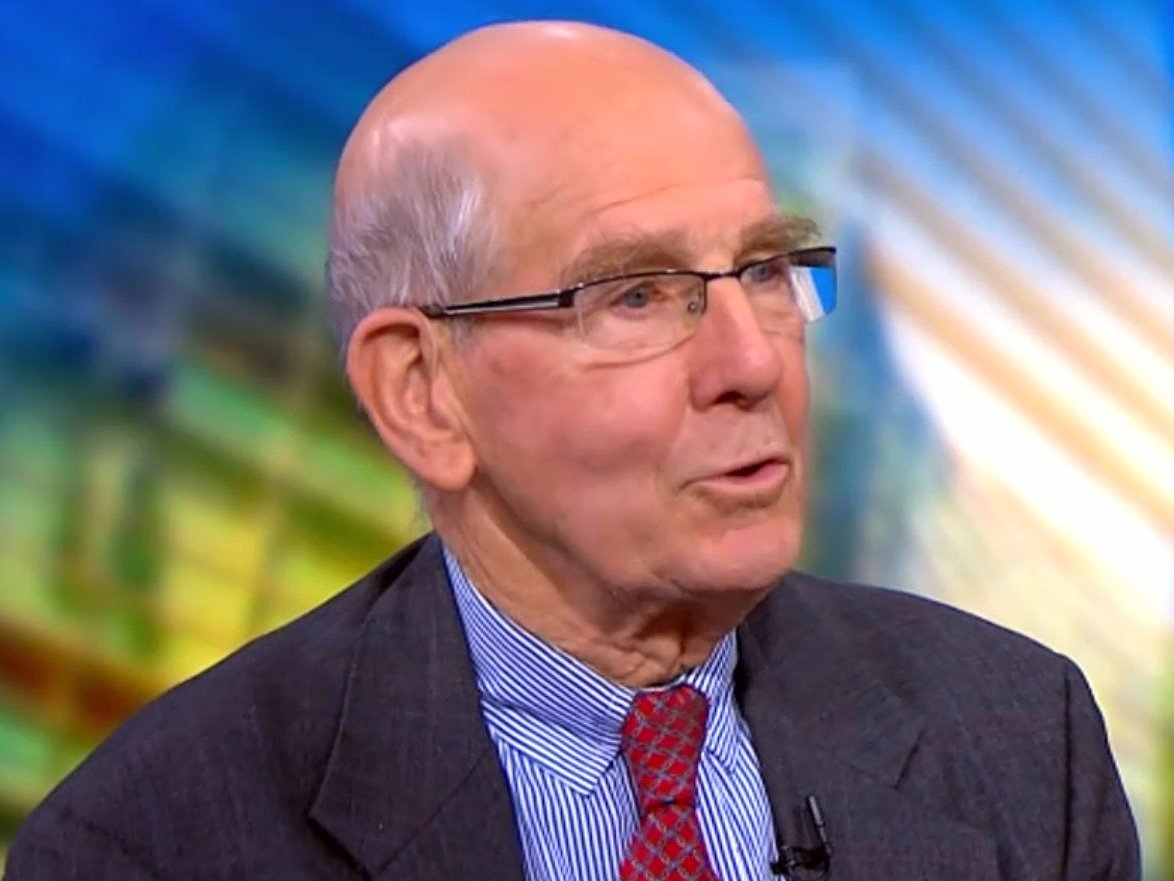

Gary Shilling is the president of A. Gary Shilling & Co., and was Merrill Lynch’s first economist in the 1980s.

We asked Shilling about the election, and if he has any update to his forecast for a 1% yield on the 10-year Treasury.

This interview was edited for length and clarity.

Here we go:

Akin Oyedele: The consensus seems to be that a Trump win might not be positive for markets. Do you agree, and is there an exaggeration of the market reaction if Trump wins?

Gary Shilling: A Trump win might be bad for stocks, but it would be very positive for the dollar and Treasurys.

Now, that sounds ridiculous on the surface, because here’s this loose cannon who’s unpredictable. But that’s the point. He is so unpredictable that foreigners are going to look around and say “boy, we’ve got to head for the safe havens.” And one of the safe havens is Treasurys and [another is] the dollar.

We’ve seen that in the past that where you’ve had uncertainty, and even where the Fed is raising rates, Treasurys rise as everybody heads for safety.

Machiavelli said it’s better to be feared than to be loved. If someone loves you, they can fall out of love with you but they’re probably going to keep fearing you. That’s where we are with Trump.

Oyedele: How good would either candidate be for the economy?

Shilling: It’s awfully hard to even speculate. What they say going in and what they end up doing are terribly different.

Let’s say Trump wins. Is Congress going to let him build a wall on the Mexican border? I don’t think so. Yes, we’re in a protectionist era because when you have lack of domestic growth, everybody tries to unload the problem on foreigners with protectionism, devaluations, cutbacks on imports. But is there going to be a dramatic change? TPP is dead anyway, and similar deals in the eurozone are going nowhere.

And if Hillary is elected, is she going to be able to jack up taxes with virtually no deductions, and include capital gains? Unless democrats have a clean sweep of Congress, I don’t think that’s going to happen either.

The one thing I think is likely to happen under either candidate is massive fiscal stimulus. You have so many voters in Western Europe and North America who’ve had no real income growth for over 10 years, and they are, in the words of Howard Beale, “Mad as hell and not going to take it anymore.”

Akin Oyedele: A while ago, you put a 1% forecast on the 10-year Treasury yield, and 2% on the 30-year. Are you still bullish on bonds [implying that bond prices will rise and their yields will fall]?

Gary Shilling: Yes I still am for three reasons.

One is the safe-haven effect. We’re in a pretty tumultuous world, and there’s a lot of uncertainty. Treasurys are where people go as one of the few safe havens in the world.

The second thing is that despite the recent conviction of many that we’re headed back to inflation, I think deflation remains the more likely prospect. You’ve just got too much excess capacity in the world.

The third reason is that Treasurys, as low as yields are, are higher than they are in most other developed countries. A foreign investor picks up a yield spread in Treasurys versus their own sovereigns, plus the fact that if the dollar is going to continue rallying — and I think it will because it’s a safe haven — then they get a currency translation gain as well.

Oyedele: But with the specter of a Federal Reserve rate hike coming, do you see any upward pressure on yields?

Shilling: Not really. If you look back historically at the post-WWII period on average, if you get a 100-basis-point increase in Fed funds, the spillover to the ten-year is only 35 basis points, and 25 basis points into the 30-year — it’s a fairly small spillover effect.

Another factor here is that I think that the Fed wants to raise rates because they’ve been yelling and screaming about it. They’ve been crying wolf for so long that their credibility is shot, and I think they feel they need to.

Investors aren’t willing to accept the idea that we’re in an era of lower returns. And the Fed worries about those distortions.

One of the things I think is very likely is that with the prospects of robust fiscal stimulus in response to voters mad as hell, the Fed is going to be in there with helicopter money. In other words, they’re going to be buying whatever the Treasury issues. They’re not going to, in effect, advocate strong fiscal stimulus and then not finance it. And that’s helicopter money.

Oyedele: Oil prices have held in a $40 to $50 range for some time even though there’s been no solid OPEC agreement and US inventories are still high. Why are prices still holding up, and is there a bigger correction coming?

Shilling: I think so.

There was a bounce a year ago that didn’t hold, then you got down to $26 per barrel on WTI in February, then you got up to about $50, now we’re back to $45. I said earlier last year that I thought we’d get to 10 or 20 bucks because that’s the marginal cost, and when you’re in a price war, it’s the marginal cost that determines the price.

It is a price war because basically the OPEC reason did not cut production in their November 2014 meeting was that they got tired of cutting production and having American frackers and Russians et cetera grab market share. OPEC production went from 30 million barrels a day to 33 million. They flooded the market, and it’s lost them a lot of money. Look at the Saudis: they just floated a $17.5 billion debt offering, they earlier borrowed $10 billion from a group of international banks; they’re selling part of Aramco — they’re desperate for money.

What’s happened is that in their game of chickens, they are the chickens. The cuts they’re talking about are not meaningful — about 600,000 or 800,000 barrels a day, which is easily made up by frackers who are now coming back to life with increased productivity, and Russians as well.

So they are right back to where they were, except now they have lower credibility. They are the swing producer, and of course the serious question is whether they’re going to get agreement. They already exempted Libya, Nigeria, and Iran. I think it was just wishful thinking that they were going to do anything to agree to cut production meaningfully in any way.