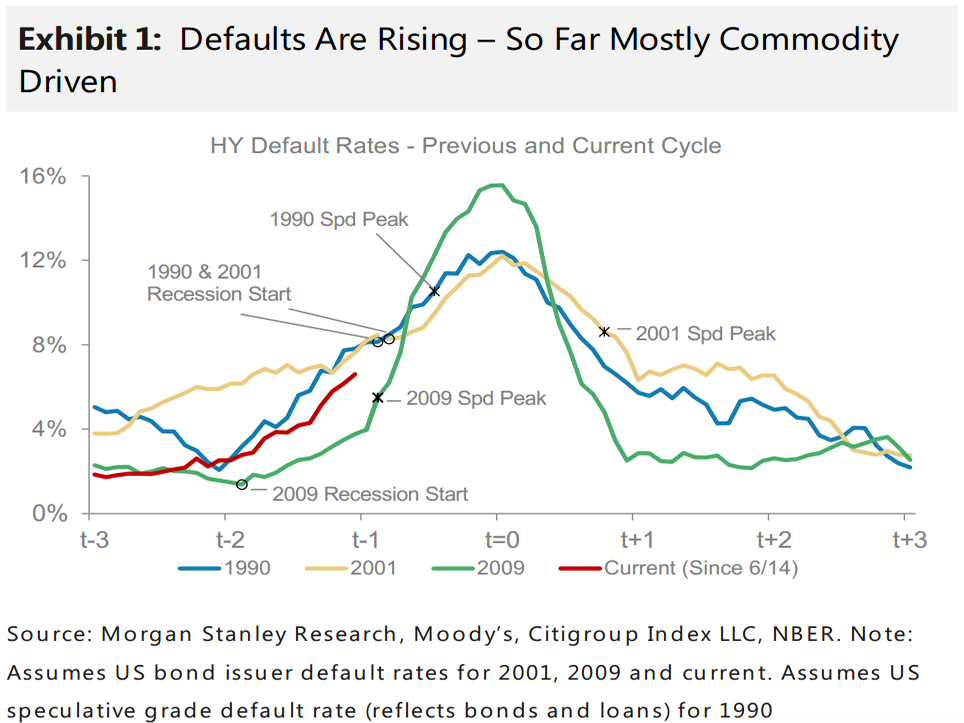

This corporate-credit cycle is almost over.

Several signs point to the end of this credit cycle, possibly within a 12-month timeframe, according to Michael Swell, co-head of global portfolio management at Goldman Sachs.

“Credit looks expensive and we’re starting to enter the late stages of the credit cycle,” Swell said during a panel discussion at UBS’ CIO Global Forum on Thursday.

“We are a little bit concerned about corporations’ ability to be able to meet their debt obligations over time.”

The stages of a credit cycle are roughly as follows: First, there’s an economic downturn accompanied by a recession. As more companies default, they work to reduce the amount of debt they have.

In the next stage, growth returns, although it’s not super-impressive. Meanwhile, companies are making considerable progress towards reducing their leverage.

The third is the expansion phase, when companies start raising their leverage again. This is where we are now.

For Swell, there are three reasons why this phase is nearing its end. There’s been an increase in leverage; the Federal Reserve has kept interest rates historically low since the last financial crisis, and that’s made borrowing attractive. At the same time, earnings growth has not been impressive.

Corporate debt at the 2,000 or so largest US firms rose to $6.6 trillion at the end of 2016, up from $3.8 trillion six years prior, according to S&P.

The second reason is narrowing profit margins, the best indicator of a recession according to Swell.

Thirdly, he identified more incidents of corporate accounting irregularities.

Other important variables include a potential slowdown of US economic growth, and political uncertainty in America and elsewhere.

Swell clarified that on balance, companies are still meeting their debt obligations.

There’s proof in Bank of America Merrill Lynch’s US fallen angel high yield index, which comprises debt instruments that were rated investment grade — with minimal default risk — when they were issued, but are now appraised lower. It rose 6.5% in the first quarter, its best gain in four years according to Bloomberg.

However, Swell said that performance was mainly because of the improvement in oil prices.

Investors have flocked into corporate debt — including risky junk bonds — because higher yields are available than on safer US Treasury bonds, and better than the negative yields in developed markets like Japan and, recently, Germany.

“Our gut is that this doesn’t end very well,” Swell said.