This story was delivered to BI Intelligence “Payments Briefing” subscribers. To learn more and subscribe, please click here.

At its 2016 I/O developer conference, Google announced several front- and back-end updates to Android Pay, its proprietary mobile wallet. These updates could introduce additional use cases for the service and accelerate usage and adoption.

New developer APIs will make in-app and mobile web integration simpler.

- In-app: Android Pay is already integrated into a limited number of apps. But the firm announced a plan to make the API publicly available to all developers in Android Pay markets whose apps sell physical goods and services. Simplifying developer access could expand the service to a broader network of apps and a wider audience.

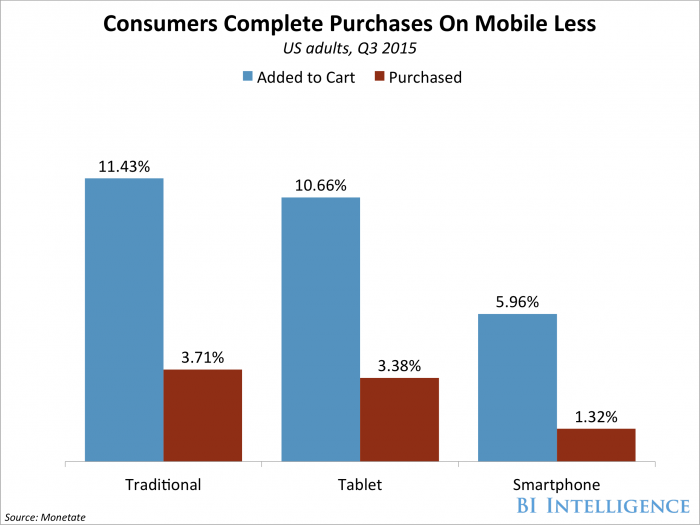

- Mobile web: Google is also working on a new API called PaymentRequest, which will allow Chrome developers to offer Android Pay as an in-browser payment option on the mobile web. That could further broaden the wallet’s addressable audience, since mobile users tend to spend the majority of their commerce-related shopping time in browsers but complete purchases at a much lower rate than PC users due to friction associated with slower connections and small screens.

The firm also bolstered Android Pay’s loyalty function and added ATM operability.

- Loyalty: Android Pay users can add loyalty and gift cards by selecting a deep link via an email, SMS message, or push notification. That streamlined feature could increase the frequency with which users activate loyalty cards in the app. And loyalty and rewards programs are popular with mobile wallet users — just a few months after loyalty functionality was added to peer wallet Apple Pay, store and loyalty cards comprised 25% of cards loaded into the wallet.

- ATM: Bank of America is piloting NFC-based ATM withdrawals, where users can tap their Android Pay-enabled phone to an ATM to access their account in place of inserting or swiping a debit or bank card.

Google’s expansion of Android Pay’s use cases could help make Android Pay more competitive while accelerating adoption and pushing users to test the service.

Mobile wallets have lagged in adoption because limited in-store and in-app acceptance has hindered habit formation among potential wallet users. The upgrades could attract new users to Android Pay while giving existing users more opportunities to pay with the wallet on a regular basis and therefore form habits around it.

Mobile payments are becoming more popular, but they still face some high barriers, such as consumers’ continued loyalty to traditional payment methods and fragmented acceptance among merchants. But as loyalty programs are integrated and more consumers rely on their mobile wallets for other features like in-app payments, adoption and usage will surge over the next few years.

Evan Bakker, research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on mobile payments that forecasts the growth of in-store mobile payments in the U.S., analyzes the performance of major mobile wallets like Apple Pay, Android Pay, and Samsung Pay, and addresses the barriers holding mobile payments back as well as the benefits that will propel adoption.

Here are some key takeaways from the report:

- In our latest US in-store mobile payments forecast, we find that volume will reach $75 billion this year. We expect volume to pick up significantly by 2020, reaching $503 billion. This reflects a compound annual growth rate (CAGR) of 80% between 2015 and 2020.

- Consumer interest is the primary barrier to mobile payments adoption. Surveys indicate that the issue is less the mobile wallet itself and more that people remain loyal to traditional payment methods and show little enthusiasm for picking up new habits.

- Integrated loyalty programs and other add-on features will be key to mobile wallets taking off. Consumers are showing interest in wallets with integrated loyalty programs. Other potential add-ons, like in-app, in-browser, and P2P payments, will also start fueling adoption. This strategy has been proved successful in China with platforms like WeChat and Alipay.

In full, the report:

- Forecasts the growth of US in-store mobile payments volume and users through 2020.

- Measures mobile wallet user engagement by forecasting mobile payments’ share of their annual retail spending.

- Reviews the performance of major mobile wallets like Apple Pay and Samsung Pay.

- Addresses the key barriers that are preventing mobile in-store payments from taking off.

- Identifies the growth drivers that will ultimately carve a path for mainstream adoption.

To get your copy of this invaluable guide, choose one of these options:

- Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

- Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of how mobile payments are rapidly evolving.

EXCLUSIVE FREE REPORT:

EXCLUSIVE FREE REPORT:5 Top Fintech Predictions by the BI Intelligence Research Team. Get the Report Now »