This story was delivered to BI Intelligence “Payments Briefing” subscribers. To learn more and subscribe, please click here.

Paytm, India’s most popular mobile wallet company, is continuing its push into the financial services sector, according to The Economic Times. The firm is seeking out a license to set up a money market fund, and it’s planning to go live on India’s Unified Payment Interface (UPI).

Paytm recently became the second nonbank to leverage India’s payment bank initiative, which works to give more consumers access to mainstream financial services. As part of the initiative, Paytm will be able to accept deposits, issue debit cards, and facilitate online transactions, but it won’t be able to lend money to consumers.

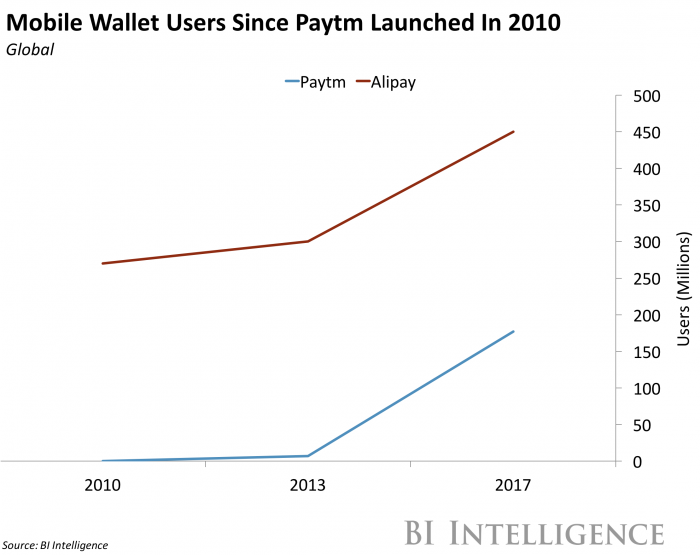

These moves are aimed at helping Paytm reach its goal of 200 million accounts within the next year, and 500 million by 2020.

- Paytm will make it simpler for its users to transfer money from bank to bank. Paytm Payments Bank expects to go live on UPI by August. UPI allows customers of participating banks to send and receive money via smartphone by simply using an ID number from Aadhaar, the biometric-enabled national ID system. The platform has multiple functions, including real-time peer-to-peer (P2P) transactions and barcode-based in-store payments.

- Disrupting the financial services industry could prove to be quite fruitful for Paytm. The mobile wallet company hopes to obtain its money market fund license so its users can hold cash while earning interest. This follows the lead of Chinese financial service giant Ant Financial — an investor in Paytm — which introduced its own money market fund five years ago and has seen tremendous success. Ant’s Yu’E Bao is now the world’s largest money market fund, with $165 billion in assets.

This is likely only the beginning of Paytm’s encroachment on traditional financial services. Paytm was able to successfully leverage the Indian government’s removal of several banknotes in November — these banknotes represented 86% of cash in circulation — to boost adoption of its digital offerings. The firm added 20 million users in the first month after demonetization, and more than 50 million by February to surpass 200 million users. With the backing of this massive user base, Paytm is able to introduce new features that can immediately trump that of traditional players. For example, the company gave its users the ability to trade gold digitally, which quickly “swelled to volumes that rival those at India’s largest traditional jewelers,” according to The Economic Times. Paytm will likely continue riding this success as it looks to further disrupt the financial services industry.

Ayoub Aouad, research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on payments disruption that:

- Identifies the biggest drivers that are upending the payments industries in India, East Africa, Latin America, and Australia.

- Discusses what pain points digital payment services are solving.

- Details what specific technologies and services are being introduced that consumers are embracing, which can be leveraged by companies in these regions that are ripe for disruption.

- Assesses how leaders in the space can leverage these trends to either improve their capabilities or to identify which markets may be ripe for disruption and worth exploring.

- And much more

To get the full report, subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND more than 250 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> Learn More Now

You can also purchase and download the report from our research store.

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends