Cross-asset correlations that existed in markets before the 2016 US election have crashed for the first time in over a decade, according to Morgan Stanley.

“‘Crash’ is not a term used lightly (indeed our editors here at Morgan Stanley won’t let us use it without a good reason),” Phanikiran Naraparaju and a team of strategists wrote in a note on Friday.

“But we struggle to think of another word to describe just how much, and how sharply, cross-asset correlations have fallen. In just four months, we have gone from a market of unusually close linkages across markets to one with usually divergent returns.”

Naraparaju noted that these collapses in correlations usually happen in the late stage of an economic cycle. By this time, individual assets are influenced more by events peculiar to them and less by broader concerns about an economic downturn, Naraparaju said. In other words, market drivers become more diverse, so the linkages between various assets break down.

Morgan Stanley identified three areas in which correlations have fallen. The first is cross-asset correlation, or how closely prices in different assets move relative to each other. Naraparaju pointed to a breakdown in the link between interest rates and stocks: The rising dollar has not hurt the stock market’s rise in the way some expected it to.

Additionally, cross-region correlation, the relationships among different regions of the same asset class — for example, European versus Japanese rates — has also broken down. Morgan Stanley pointed to the effects of divergent monetary policy and political risks across the world.

Thirdly, intramarket correlation of securities within an index like the S&P 500 has crashed.

For fund managers, “it seems reasonable that it’s hard to extract alpha from macro trends when all markets are moving together,” Naraparaju said. Alpha is a gauge of performance.

“With that shifting, the backdrop should be better,” Naraparaju added.

However, hedges that are set up in one asset class based on its correlation with another could no longer serve as effective protection.

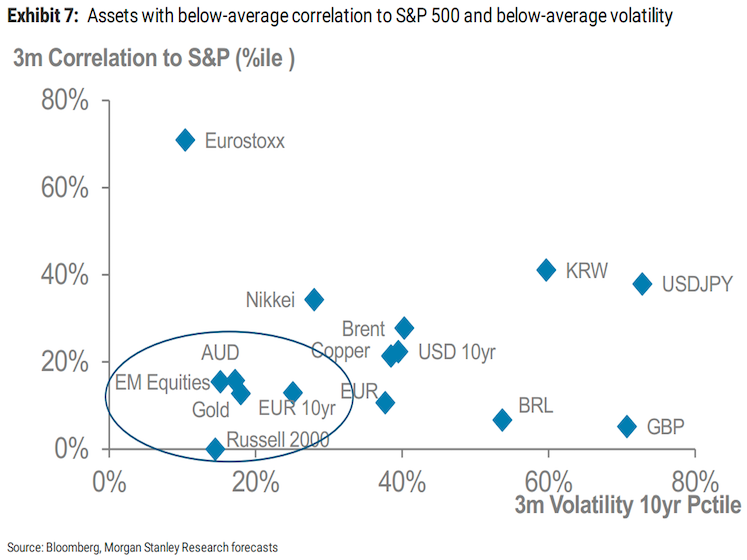

“We’d expected correlations to rise again if growth data disappointed,” Morgan Stanley wrote. “Since lower correlation has helped to depress volatility, hedges that benefit from both correlation and vol moving benefit from unusually good pricing now. Our favorites are AUDUSD, gold, and EURUSD.”