This story was delivered to BI Intelligence “Fintech Briefing” subscribers. To learn more and subscribe, please click here.

Initial coin offerings (ICOs), a form of fundraising involving digital tokens, have gained popularity recently, prompting diverse parties to devote attention to how ICOs might fit into existing regulatory frameworks.

Now, six Chinese blockchain technology industry associations have jointly published a framework, dubbed the Guiyang Blockchain ICO Consensus, suggesting ways blockchain technology companies should behave to reduce investor and stability risks around such token sales in China. The framework is purely advisory, however, since the six associations don’t have legislative powers.

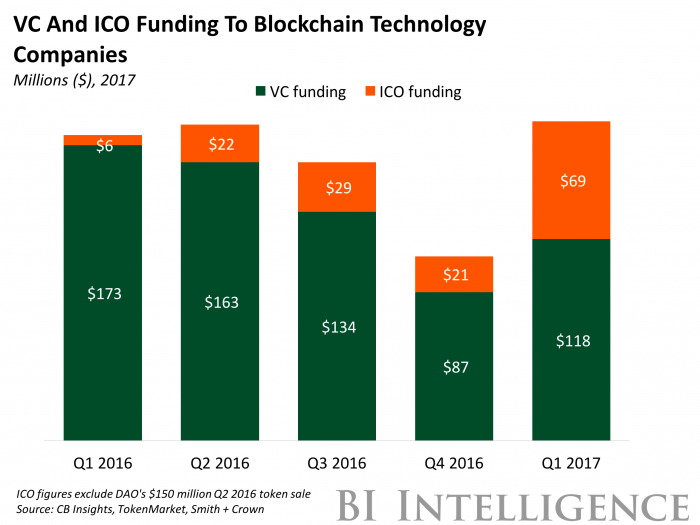

Given how quickly ICOs have taken off, the associations’ focus on this fundraising method is understandable. ICO fundraising volumes have reached $420 million in China, attracting over 100,000 participants, and there are now more than 40 platforms offering ICOs nationwide, according to Chinese media. China currently has no ICO-specific rules, but the People’s Bank of China (PBOC) has begun looking at how to regulate fintech as a whole, including by opening a digital currency center and conducting cryptocurrency exchange inspections. As ICOs get more traction, however, the regulator is likely to begin addressing them specifically, and may use the Guiyang framework to guide its own approach.

It’s questionable how much value an ICO-specific framework will add. It seems increasingly clear that there isn’t necessarily a need for a separate set of guidelines like the Guiyang protocol for ICOs — for example, the Securities and Exchange Commission (SEC) in the US just published a report in which it suggests regulating some digital tokens and ICOs as securities. As such, the PBOC might well follow suit and simply clarify its existing financial regulations to include disruptive developments like ICOs. Arguably, the ICO boom is serving as a reminder that fintech is a component of mainstream financial systems, and should be regulated in a way that allows it to augment financial services, rather than be treated as an appendage to the broader industry.

Sarah Kocianski, senior research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on blockchain in banking that:

- Outlines banks’ experiments with blockchain technology.

- Details blockchain projects at three major banks — UBS, Credit Suisse, and Banco Santander — based on in-depth interviews.

- Discusses the likely trends that will emerge in the technology over the next several years.

- Highlights the factors that will be critical to the success of banks implementing blockchain-based solutions.

To get the full report, subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and more than 250 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>Learn More Now

You can also purchase and download the full report from our research store.

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends