MyPrivateBanking

MyPrivateBanking

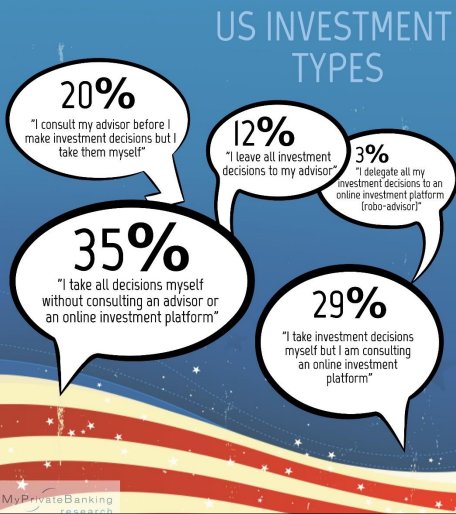

This is a main finding of MyPrivateBanking’s recent quantitative panel survey report “Investors’ Attitudes towards robo advisors – Evidence from the US and the UK“, with insights from 600 affluent and wealthy investors in the US and the UK.

The report analyzes in depth the views and opinions of individual investors with regard to the robo advisor topic. Besides exploring investors’ attitudes towards specific features of online investment platforms, the survey tests brand awareness and the target market’s level of openness towards innovation in this field. In addition to the comprehensive analysis all results are detailed in extensive data appendices.

High-net-worth individuals use online investment tools more than other investors

More than 70% of overall respondents think that such tools can positively influence their wealth manager’s advice and decision-making process and that automated advice potentially speeds up onboarding processes such as registration and account opening, making these processes more efficient and convenient. This underlines how the young and the wealthy are especially showing a great openness, awareness and knowledge about robo advice.

Interestingly, the adoption of automated wealth advice is happening faster in the high-net-worth segment than mass affluent with current usage of online wealth management tools at 43% and 17%, respectively. The report also identifies the major concerns investors have in respect to robo advisors and how the respondents rate the quality of human advice compared to that of robo’s.

UK and US investors are both open to robo advice, but differ in their sensitivity to price

Overall, investors on both sides of the Atlantic show strong similarities in their awareness and openness towards automated / robo advice, which are detailed in the report. Despite the trends both countries have in common, some striking differences were also observed. Among them, this includes the finding that UK investors would pay more for robo (and human-only) advice and in the US, a much higher share of respondents state that they don’t think they will use robo advice tools in the future. The report identifies the price point investors would pay and also the various levels of brand awareness current leading robo advisors have with investors in the US and UK.

Wealth management industry’s future will be in automated advisory services

The report provides clear, empirical evidence on why automated advice and robo services are a significant part of every wealth manager’s future. It shows how automation can enhance client satisfaction throughout the different stages of the advisory process and which channels investors like to use to contact their wealth managers. The report also identifies the most important value-added services investors would like to see in a robo advisor tool and to which target segments automated services appeal most.

This 258-page report (48 pages of analysis and commentary plus 210 data chart pages) provides banks, wealth managers, fund managers and robo advisors with the data and analysis they need to make the right decisions on how to best serve affluent and high-net-worth individuals via online investment platforms.

The report tells you all you need to know about the behaviors, attitudes and needs of the wealthy with respect to robo advice in the US and the UK. In addition to exploring investors’ attitudes towards specific features of online investment platforms, the survey tests brand awareness and the level of openness towards innovation in this field. The key findings for each country are presented in the report and assessed for their impact on wealth managers targeting affluent and wealthy US and UK investors.

The report is based on a quantitative panel survey with a total of 600 randomly selected mass affluent, affluent and high-net-worth participants in the UK and the US (300 from each country). All survey data are detailed in the comprehensive appendix to the report, with individual splits by country and further segmentation by criteria such as wealth (amount of investable assets) and age.

The report provides detailed analysis and data-driven insights into the client’s view of robo advice:

- Levels of awareness regarding robo advisors in different wealth segments

- Usage of robo advisors and online investment platforms by affluent/HNWIs and characteristics of those users

- Share of assets that affluent/HNWIs are willing to manage with an online investment tool

- Expectations of affluent/HNWIs on the length and depth of the registration process during on-boarding for an online investment platform

- Brand awareness of the leading robo advisors in the US and the UK

- The level of fees affluent/HNWIs would pay as a % of managed assets for automated online advisory tools

- Main advantages and disadvantages affluent/HNWIs see in robo advice

- Technical features that online investment platforms should offer

- Investment tasks which affluent/HNWIs expect an online advisory platform should offer

- How affluent/HNWIs interact with their advisor and how they feel about future client-advisor communication channels

- Satisfaction of affluent/HNWIs in seven key services offered by their wealth manager

- Four comprehensive data appendices (individual splits by country and further segmented by criteria such as Amount of investable assets and age)

>>Click here for Report Summary, Table of Contents, Questionnaire (PDF)<<

Here’s how you get this exclusive robo advisor research: MyPrivateBanking

MyPrivateBanking

To provide you with this exclusive report, MyPrivateBanking has partnered with BI Intelligence, Business Insider’s premium research service, to create The Complete Robo Advisor Research Collection.

If you’re involved in the financial services industry at any level, you simply must understand the paradigm shift caused by robo advisors.

Investors frustrated by mediocre investment performance, high wealth manager fees and deceptive sales techniques are signing up for automated investment accounts at a record pace.

And the robo advisor field is evolving right before our eyes. Firms are figuring out on the fly how to best attract, service and upsell their customers. What lessons are they learning? Who’s doing it best? What threats are traditional wealth managers facing? Where are the opportunities for exponential growth for firms with robo advisor products or models?

The Complete Robo Advisor Research Collection is the ONLY resource that answers all of these questions and more. Click here to learn more about everything that’s included in this exclusive research bundle.

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends