This story was delivered to BI Intelligence “Payments Briefing” subscribers. To learn more and subscribe, please click here.

Samsung announced a partnership with Visa that will integrate Samsung Pay with Visa Checkout, Visa’s buy-button offering, according to Finextra. As a result of the partnership, Samsung Pay customers will be able to tap a co-branded Samsung Pay/Visa Checkout button at any merchant that offers Visa Checkout and authenticate their purchase using a fingerprint, per Venture Beat.

This is Samsung Pay’s second buy-button partnership, following one forged with Masterpass last October, and will launch by the end of this year in any market where both services are live.

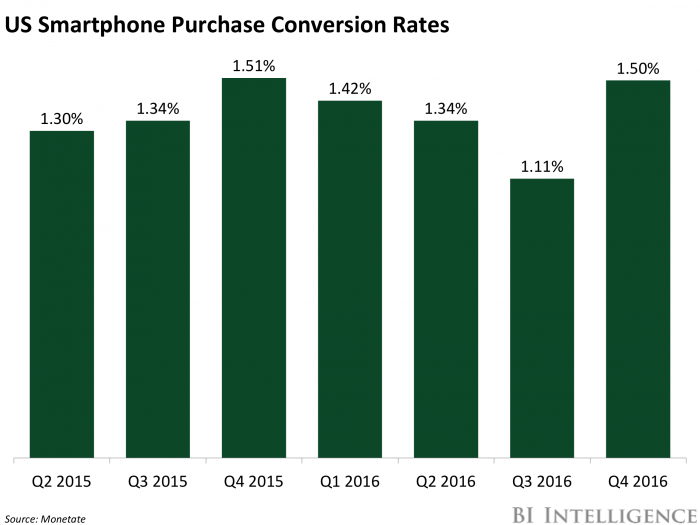

The move could make online purchasing easier for a vast number of users. Mobile purchasing is challenging, thanks to friction associated with slower connections and small screens. That leads to low conversion rates — in Q4 2016, US smartphone conversion rates were 1.5%, compared to 4.3% on desktop — which single-click solutions help resolve, by allowing users to skip challenging steps like billing and shipping information entry. Visa Checkout has improved completion rates by up to 86%, according to a ComScore study. Now, Samsung Pay will have access to that at scale: The service counts over 300,000 partner merchants representing $173 billion in addressable volume, which Samsung Pay will now be exposed to.

That could help grow the wallet’s user base and volume, ultimately posing a threat to other players in the space.

- Those improvements could onboard new users. The use case for in-store mobile wallets isn’t strong. But that’s not true online, because they can resolve some of the aforementioned frictions. That means the benefits that the Visa Checkout integration brings could draw in a lot of users, especially since the wide merchant network makes it relatively ubiquitous. Those users might then turn to Samsung Pay for other circumstances, like in-store purchasing, therefore growing both adoption and engagement.

- This threatens other players like PayPal. Alternative payment firms like PayPal have long dominated the online checkout space. Now, those firms are trying to move in-store, with limited success. Phone-based mobile wallets could prove more convenient, especially with their wide reach, which in turn could hinder adoption and usage of other single-click services trying to break into the multiuse mobile wallet market.

Peer-to-peer (P2P) payments, defined as informal payments made from one person to another, have long been a prominent feature of the payments industry.

That’s because individuals transfer funds to each other on a regular basis, whether it’s to make a recurring payment, reimburse a friend, or split a dinner bill.

Cash and checks have historically dominated the P2P ecosystem, and they’re still a popular tool. But as smartphones become a primary computing device, top digital platforms, like Venmo and Google Wallet, have enabled customers to turn away from cash and make those payments digitally with ease. Over the next few years, though overall P2P spend will remain constant, a shift to mobile payments across the board and increased spending power from the digital-savvy younger generation will cause the mobile P2P industry to skyrocket.

That poses a problem for firms providing these services, though. Historically, most of these players have taken on mobile P2P at a loss because it’s a low-friction way to onboard users and won’t catch on unless it’s free, or largely free, to consumers. But as it becomes more popular and starts to eat into these firms’ traditional streams of revenue, finding ways to monetize is increasingly important. That could mean moving P2P functionality into more profitable environments, leveraging existing networks of friends to encourage spending, or offering value-added services at a nominal fee.

Jaime Toplin, research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on mobile P2P payments that examines what’s driving this shift to mobile P2P and explains why companies need to find a way to capitalize on it quickly. It discusses how firms can use the tools they have to gain in the P2P space, details several cases, and evaluates which strategies might be the most effective in monetizing these platforms.

Here are some key takeaways from the report:

- Consumers still want mobile P2P services, and they’re turning to them. Individuals pay their peers on a regular basis, and as smartphones are increasingly used as computing devices, these consumers look to such services for fast and easy ways to pay.

- Monetizing P2P is more important than ever. Initially, P2P was a valuable onboarding tool for companies, and when it was still a small segment, taking it on at little value or a loss didn’t have major implications. But as volume grows and user bases scale fast, finding ways to monetize quickly should be a priority for firms looking to stay ahead.

- New technology could put some apps ahead of their peers. P2P continues to rely on networks, especially for informal, social transactions. But rather than having a large network, it’s becoming important for firms to understand their user bases and the networks within them. This means that chat apps, and leveraging bot and AI technology, may offer a distinct advantage.

In full, the report:

- Forecasts the growth of the P2P market, and what portion of that will come from mobile channels, through 2021.

- Explains the factors driving that growth and details why it will come from increased usage, not increased spend per user.

- Evaluates why mobile P2P isn’t profitable for companies, and details several cases of attempts to monetize.

- Assesses which of these strategies could be most successful, and what companies need to leverage to succeed in the space.

- Provides context from other markets to explain shifting trends.

Interested in getting the full report? Here are two ways to access it:

- Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>START A MEMBERSHIP

- Purchase & download the full report from our research store. >> BUY THE REPORT

EXCLUSIVE FREE REPORT:

EXCLUSIVE FREE REPORT:5 Top Fintech Predictions by the BI Intelligence Research Team. Get the Report Now »