Stocks across the board in Europe are surging on Monday morning, taking a leg higher as markets continue to digest Donald Trump’s shock election win last week, and adjust to a more conciliatory and level-headed approach than many had expected from Trump in his first few days as President-elect.

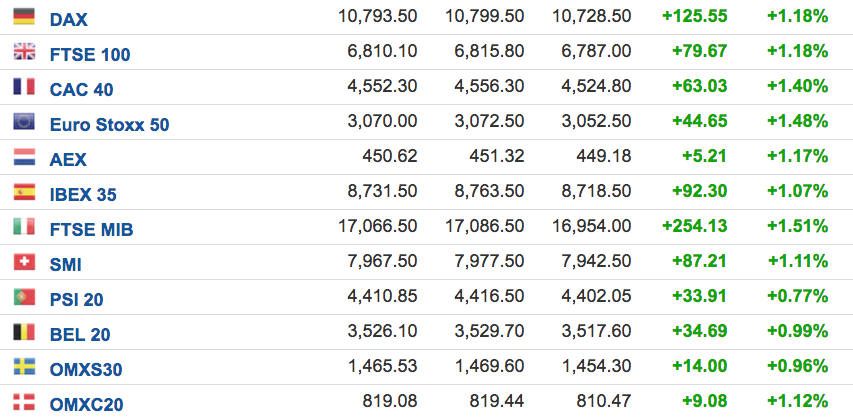

With just over half an hour of trading done, all of Europe’s major stock indexes are higher by more than 1%, with both France’s CAC 40, and Italy’s FTSE MIB 1.5% up.

Here is the scoreboard as of 8.35 a.m. GMT (3.35 a.m. ET):

Investing.com

Investing.com

As Mike van Dulken, head of research says in an emailed statement on Monday morning:

“A positive start to the week comes from further easing of concerns about a Trump presidency. Certain appointments (chief of staff, chief strategist) have proved more conventional than feared, while certain populist issues aren’t being focused on so much. Expectations of an infrastructure spending spree, fiscal stimulus and deregulation are, however, intensifying the bond market sell-off via hopes of growth, inflation and, more importantly, interest rate rises.”

Trump named Republican National Committee Chairman Reince Priebus as his chief of staff and appointed campaign CEO Steve Bannon as chief strategist on Sunday. CNN reported that House Speaker Paul Ryan, Senate Majority Leader Mitch McConnell, and Trump’s son-in-law Jared Kushner urged the president-elect to pick Priebus.

Priebus is a mainstream figure within in the GOP, and his appointment is seen as something of an olive branch to the Republican establishment from Trump. He is also seen as a steady hand on the tiller within the White House.

In Britain, the FTSE 100 is getting additional support from a weaker pound on the day, with the pound sliding against the dollar, thanks to a big rally in the greenback after US bond yields surged in overnight trade. Here is the chart:

Investing.com

Investing.com

Though a weaker pound might seem like bad news for UK stocks, about 70% of the revenue of the companies that make up the FTSE 100 is derived from abroad, meaning they make more money when sterling is weak. That is because the index is full of mining companies, oil firms, and pharmaceutical giants that use the UK as a base but tend to denominate their assets in dollars.

Essentially, when the pound does badly, the FTSE does well, as evidenced by the near 15% gain in the index since it crashed on the day after Britain’s June vote to leave the European Union.