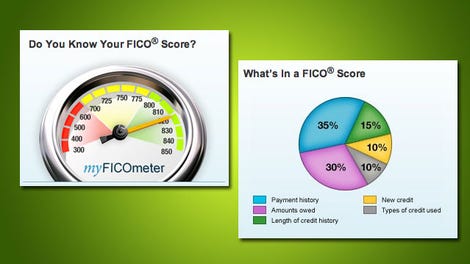

Knowing your FICO score—essentially, how your credit stacks up—is a powerful tool for getting the most competitive rate on a loan for a new car (or anything else, really), but the number that a lot of web services show you and the number that the lenders really use may be very different.

Advertisement

According toAutomotive News, the Consumer Financial Protection Bureau fined the credit rating bureau Experian $3 million for allegedly misleading customers by showing a score for “educational” purposes, and that score may not be the number that lenders use to determine credit worthiness.

In a statement, CFPB Director Richard Cordray said:

Advertisement

“Experian deceived consumers over how the credit scores it marketed and sold were used by lenders… Consumers deserve and should expect honest and accurate information about their credit scores, which are central to their financial lives.”

The CFPB says the core problem is that Experian and other bureaus like Equifax and TransUnion have developed “educational credit scores” that give consumers what is essentially an “estimate” on what their FICO looks like, but these educational scores can have huge discrepancies with the real score the lenders use.

Our friends at Lifehacker have covered this issue before with the use of “Vantage Scores” which is a composite estimate or snapshot of your FICO. The issue that the CFPB is raising has to do with the individual scores you can get from the bureaus themselves. In both instances, these scores can cause a lot of confusion for a consumer.

Sponsored

For example, a person might get an “educational” score of 703 from Experian which for most lenders would put them in the “Tier 1” credit category and should qualify them for the most competitive rates. However, their real FICO score may be a 675, while not bad, can drastically change what APR they get.

Not long ago I had a reader who was shopping for a car ask if a dealership can lie to them about their credit score. While a dealer cannot flat out tell you a completely different number than what is on your report, if they want to be sneaky about it, they can say something along the lines of “Based on your score the best rate we can give you is X…”

Knowing your FICO score will give you a pretty big clue as to whether or not the dealer is not offering you the most competitive rate, and thus how much your monthly payments will be. However, if the number you think you have isn’t the “real” one it can be difficult to determine who is telling you the truth.

Advertisement

While Experian did not admit any wrongdoing the bureau agreed to comply with the CFPB’s fine of $3 million dollars and their consent order to change the way Experian discloses scores to customers.

So how can you be sure that the FICO score you are looking at is the real one? There are numerous websites that will offer you a copy of your score for free, but often these are just estimates and not the real FICO number.

You used to be able to get a free trial on myfico.com, but it appears that they no longer offer that option. If you don’t want to sign up for what looks like a pretty expensive subscription to have access to your FICO, several banks and credit cards have been participating in FICO score open access program and will allow you to view your number on your monthly statement.