Federal Reserve officials raised interest rates in June despite worries about slowing inflation and job growth, largely because officials were still pretty sure the slowdown would quickly pass.

However, minutes from last month’s policy meeting showed a growing number of policymakers are becoming reluctant about the need for continued monetary policy tightening given the weakening in the data.

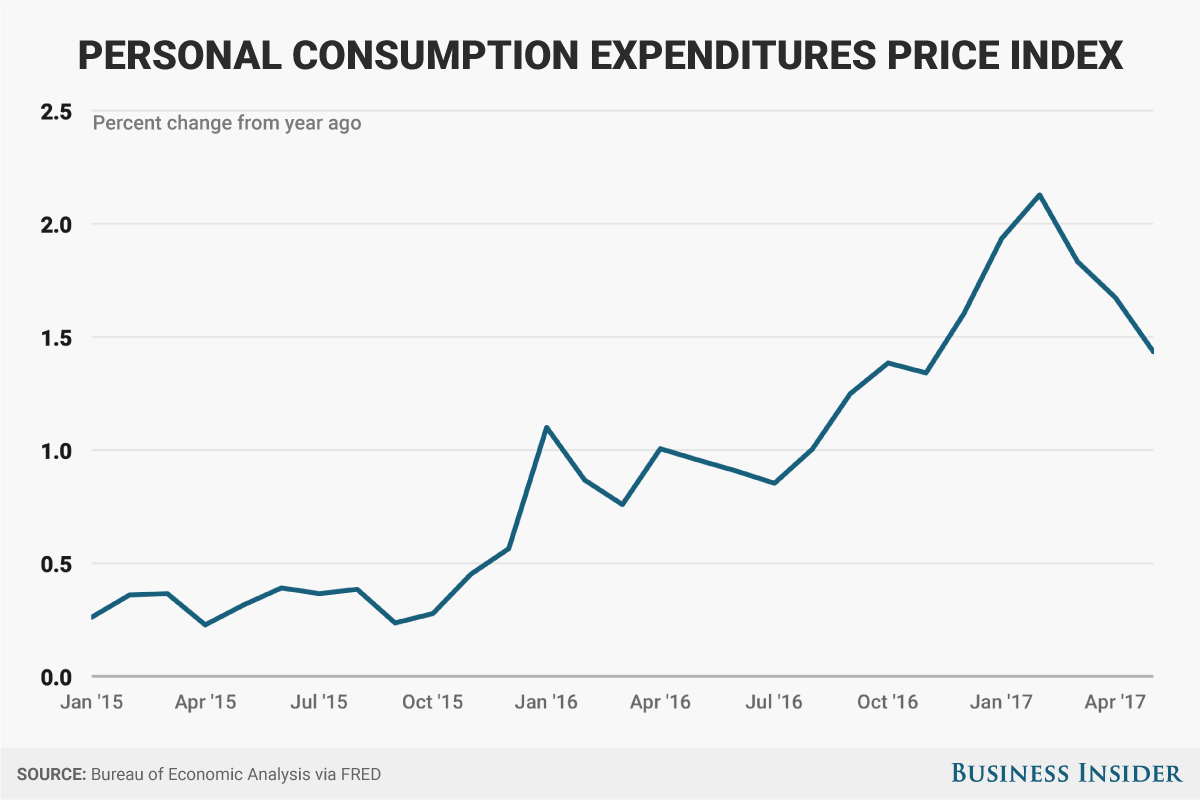

“Several participants expressed concern that progress toward the committee’s 2% longer-run inflation objective might have slowed and that the recent softness in inflation might persist,” the minutes said.

Andy Kiersz/Business Insider

Andy Kiersz/Business Insider

That suggests Minneapolis Fed President Neel Kashkari, who dissented against the decision to raise official borrowing costs to a range of 1%-1.25%, was not alone in his concerns.

“We don’t yet know if that drop in inflation is transitory,” he said in a post justifying his dissent.

Kashkari had company, the minutes showed. “With regard to the outlook for inflation, some participants emphasized downside risks, particularly in light of the recent low readings on inflation along with measures of inflation compensation and some survey measures of inflation expectations that were still low,” the report said.

Another sign of widespread caution among central bank officials: The Fed declined to identify a start-date for its much anticipated shift toward reducing the size of its balance sheet by slowly tapering off its reinvestment of maturing bonds in its $4.5 trillion portfolio. Still, some said they would like to communicate such a timeline “within a couple of months.”

In response to the deepest recession in generations and an epic financial crisis, the Fed not only drove interest rates down to zero but also bought trillions in mortgage and Treasury bonds. The idea was to stimulate investment and consumption and to revive credit and housing markets that largely ground to a halt after the bursting of a historic bubble.

Andy Kiersz/Business Insider

Andy Kiersz/Business Insider

Now, the Fed would like to reverse the process in a smooth manner, but knows the chances of market disruptions are fairly high. The most officials could agree on was that “it would likely become appropriate this year for the Committee to announce and implement a specific timetable for its program of reducing reinvestment of the Federal Reserve’s securities holdings.”

Indeed, “participants expressed a range of views about the appropriate timing of a change in reinvestment policy.”

Fed officials have good reason to be leery of their own forecasting prowess. As this chart from Deutsche Bank Economist Torsten Slok shows, their optimism has been considerably misplaced for several years running now.

Deutsche Bank

Deutsche Bank