This story was delivered to BI Intelligence “Fintech Briefing” subscribers. To learn more and subscribe, please click here.

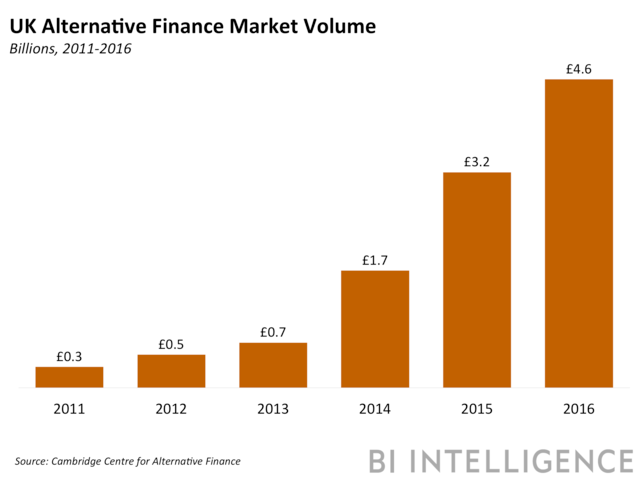

The UK’s alternative finance market — including marketplace lending, crowdfunding, and invoice trading — grew 43% year-over-year (YoY) in 2016, from £3.2 billion ($4.3 billion) to £4.58 billion ($6.17 billion), according to a recently released study from theCambridge Centre for Alternative Finance.

This marks slower growth than seen between 2014 and 2015 (86%), but still indicates the industry is in good health.

Here are the key findings from the study:

- Business marketplace lending now has the biggest share of the UK alt finance market,advancing 28.5% from £881 million ($1,180 million) in 2015 to £1,232 million ($1,651 million) in 2016. That means it has overtaken consumer marketplace lending, which previously had the largest share, but saw volumes of £1,169 million ($1,567 million) last year. This is likely partly due to lenders like Funding Circle now having been around a while, giving them time to gain brand trust, aided bygood reviewsfor their services. Additionally, businesses, on average, borrow more money than individuals, making it easier for business lenders to originate larger sums than consumer lenders.

- Property lending saw the fastest growth.The annual study only started measuring this segment in 2015, when it lent £609 million ($816 million), but it grew 88% YoY last year to reach £1,147 million ($1,537 million). Property lenders, such as LendInvest and Landbay, use investors’ money to fund loans secured by property that are typically issued to professional landlords. Such rapid growth can be attributed to the large sums required to fund such loans, along with the fact the British construction sector wasn’tas badly hit by Brexitas had been predicted.

The data suggests demand for alternative finance services in the UK is increasing.That’s likely driven by growing trust in these firms’ business models, thanks to the length of time some of the leading players have been around. Additionally, Brexit is negatively affecting consumer finances, leading people to take out more loans, as well as spend less money, which in turn, could be leading businesses to borrow more. As these factors show no signs of abating, we expect alternative finance to see further strong growth this year.

Fintech hubs — cities where startups, talent, and funding congregate — are proliferating globally in tandem with ongoing disruption in financial services.

These hubs are all vying to become established fintech centers in their own right, and want to contribute to the broader financial services ecosystem of the future. Their success depends on a variety of factors, including access to funding and talent, as well as the approach of relevant regulators.

Sarah Kocianski, senior research analyst for BI Intelligence, Business Insider’s premium research service, has put together a report that compiles various fintech snapshots, which together highlight the global spread of fintech, and show where governments and regulatory bodies are shaping the development of national fintech industries. Each provides an overview of the fintech industry in a particular country or state in Asia or Europe, and details what is contributing to, or hindering its further development. We also include notable fintechs in each geography, and discuss what the opportunities or challenges are for that particular domestic industry.

In full, the report:

- Explores the fintech industry in six countries or states, and identifies individual fintech hubs.

- Highlights successful fintechs in each region.

- Outlines the challenges and opportunities each country or state faces.

- Gives insight into the future of the global fintech industry.

Interested in getting the full report? Here are two ways to access it:

- Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>Learn More Now

- Purchase & download the full report from our research store. >> Purchase & Download Now

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends