This story was delivered to BI Intelligence “Fintech Briefing” subscribers. To learn more and subscribe, please click here.

The state regulators of Georgia, Illinois, Massachusetts, Tennessee, Texas, Kansas, and Washingtonhave struck an agreementto standardize their approaches to approving fintechs for money business licenses, which are used by companies including cryptocurrency exchanges and payments fintechs.

All seven regulators are members of the Conference of State Bank Supervisors (CSBS), an association of state banking regulators. The regulators say they expect more states to join the initiative going forward.

The participating regulators will accept licenses from each other’s jurisdictions given to a specific fintech. This won’t cover all requirements, only those that are identical from state to state. A CSBS spokesperson said that standardizing the laws states impose on fintechs wouldn’t happen soon.

However, the participants say the move will reduce a lot of the redundancy fintechs face in having to make identical submissions to each state they want to expand into. This will result in faster licensing times, make it easier for small players to expand nationwide, and lead to more efficient use of regulatory resources, they added.

While this is certainly progress, its effectiveness will depend on breadth of participation. This move follows longstanding criticism that the US isn’t doing enough to make licensing easier for fintechs by simplifying its state-by-state licensing system, so the move will be welcomed by the industry.

However, to maximize the impact of the project for fintechs, its initiators should now focus on getting all 50 state regulators on board. Arguably, until this happens, the move’s effects on the fintech industry will be modest. While it seems likely that most US state regulators will be open to joining the agreement, given the resources it will save them, the sheer number of parties involved could make onboarding complex and difficult.

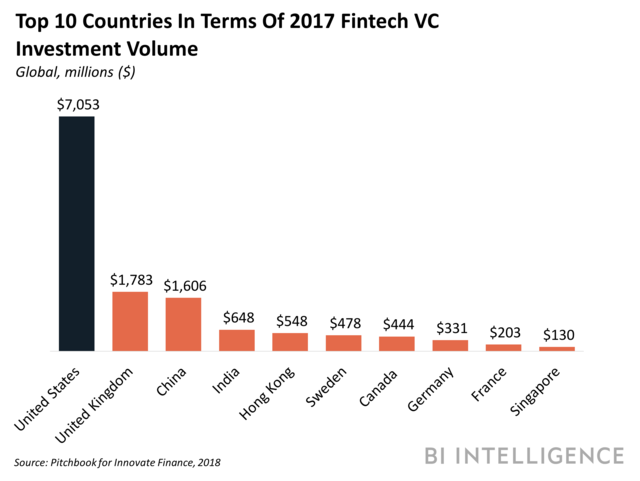

Despite having one of the largest fintech industries in the world, the U.S. is noticeably behind other regions when it comes to one factor crucial to the future growth of this burgeoning sector — regulation.

The U.S. regulatory environment is holding back fintechs and hindering their chances of success.

Sarah Kocianski, senior research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on U.S. fintech regulation that:

- Examines the current regulatory landscape in the U.S.

- Explains how it is negatively affecting the fintech industry.

- Outlines the initiatives currently in play from major regulatory agencies.

- Considers the future of U.S. fintech regulation and its potential impact on the fintech sector.

Interested in getting the full report? Here are two ways to access it:

- Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>Learn More Now

- Purchase & download the full report from our research store. >>Purchase & Download Now