This story was delivered to BI Intelligence “Payments Industry Insider” subscribers. To learn more and subscribe, please click here.

Two key segments driving growth for Vantiv

Two key segments driving growth for Vantiv

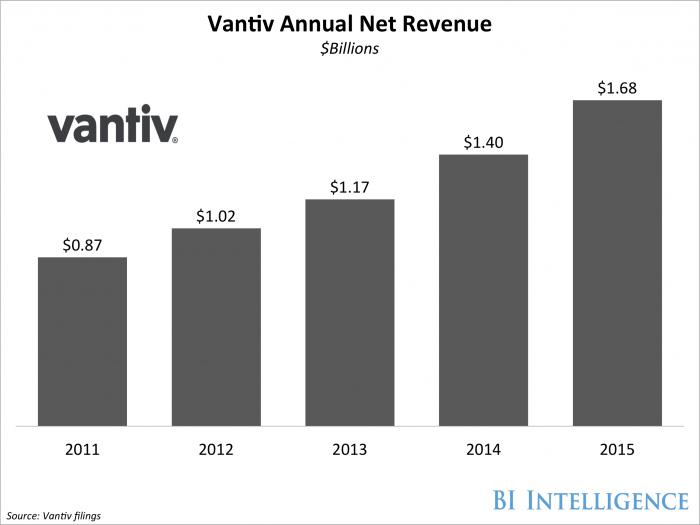

US-based processor Vantiv announced what it called an “exceptional” start to 2016 after posting a 15% annual revenue increase and strong growth across segments in its Q1 earnings report held late Tuesday.

For context, Vantiv is the second-largest merchant acquirer and top PIN debit acquirer, according to the Nilson Report.

Vantiv emphasized two segments that it sees as particularly important for ongoing growth:

- Integrated payments: Integrated payments, including e-commerce, contributed to Vantiv’s growth. That’s partly due to Vantiv completing the integration of independent software vendor (ISV) Mercury Payment Solutions, which it acquired in Q2 2015, ahead of schedule. That pushed over 100,000 merchants to Mercury’s platform in Q1 and will continue to bolster the strong performance of high-growth business segments. Mercury could also help Vantiv move into new verticals, like healthcare, and build up its small business portfolio.

- Small businesses: Like many of its peers, Vantiv continues to push to grow its market share and presence among smaller businesses. Growth in that segment was a major driver of the firm’s strong Q1 growth. And Vantiv continues to grow small business initiatives. The firm’s Mercury integration will allow it to roll out OptBlue, an Amex initiative that makes it simpler for merchants to accept American Express, to many of its partners, which could bolster growth. And it’s also working on growing small business relationships — Vantiv recently launched a new small business community, called Vantiv BizBuz, which will give small business owners the opportunity to connect with one another and access resources.

Vantiv’s small-business push, in particular, is indicative of a trend in the payments industry.Some of the firm’s peers, including Ingenico and First Data, are seeing small businesses as a major growth driver.

That’s likely because a lot of small businesses are beginning to accept card and online payments, and because the market for small-business processing remains relatively fragmented with no clear market leader. That creates significant entry opportunity, making smaller merchants a compelling population for processors to chase if they want to grow their share of the market.

This is just one piece of the rapidly evolving payments ecosystem, an increasingly complex series of transactions and players that is changing with each passing day.

Evan Bakker and John Heggestuen, analysts at BI Intelligence, Business Insider’s premium research service, have compiled a detailed report on the payments ecosystem that drills into the industry to explain how a broad range of transactions are processed, including prepaid and store cards, as well as revealing which types of companies are in the best and worst position to capitalize on the latest industry trends.

Here are some key takeaways from the report:

- 2016 will be a watershed year for the payments industry. Payments companies are improving security, expanding their mobile offerings, and building commerce capabilities that will give consumers a more compelling reason to make purchases using digital devices.

- Payments is an extremely complex industry. To understand the next big digital opportunity lies, it’s critical to understand how the traditional credit- and debit-processing chain works and what roles acquirers, processors, issuing banks, card networks, independent sales organizations, gateways, and software and hardware providers play.

- Alternative technologies could disrupt the processing ecosystem. Devices ranging from refrigerators to smartwatches now feature payment capabilities, which will spur changes in consumer payment behaviors. Likewise, blockchain technology, the protocol that underlies Bitcoin, could one day change how consumer card payments are verified.

In full, the report:

- Uncovers the key themes and trends affecting the payments industry in 2016 and beyond.

- Gives a detailed description of the stakeholders involved in a payment transaction, along with hardware and software providers.

- Offers diagrams and infographics explaining how card transactions are processed and which players are involved in each step.

- Provides charts on our latest forecasts, key company growth, survey results, and more.

- Analyzes the alternative technologies, including blockchain, which could further disrupt the ecosystem.

To get your copy of this invaluable guide, choose one of these options:

- Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

- Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the payments ecosystem.

EXCLUSIVE FREE REPORT:

EXCLUSIVE FREE REPORT:5 Top Fintech Predictions by the BI Intelligence Research Team. Get the Report Now »