BI Intelligence

BI IntelligenceSee Also

This story was delivered to BI Intelligence “Fintech Briefing” subscribers. To learn more and subscribe, please click here.

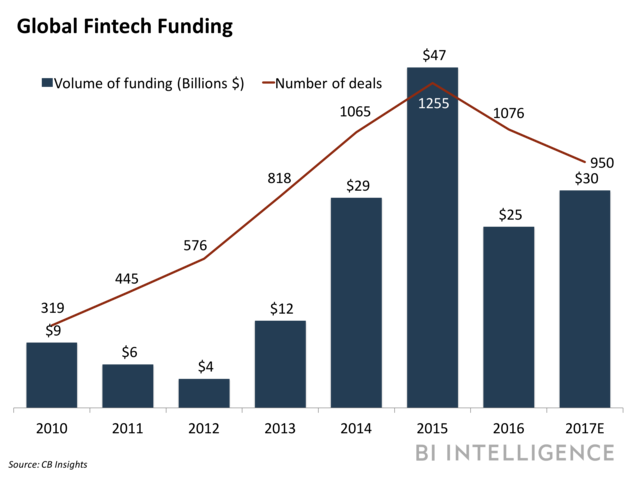

Fintech fundingcame out of the gate with a strong start in 2018. And now, three big incumbents — US financial holdings company BB&T, UK bank Standard Chartered, and Japanese financial services company SBI Holdings — are adding fuel to this trend by launching new fintech funds.

- BB&T.The companyannounceda $50 million fund that will invest in and acquire emerging fintech companies, with the aim of increasing customer satisfaction and lowering operating costs. As part of BB&T’sdigital business transformation, it has already developed new digital tools and improved its security to protect client accounts. This new fintech fund will further contribute to BB&T’s overhaul.

- Standard Chartered.The bankhas introduceda new business unit, called SC Ventures, that will invest in new fintechs as well as manage previous investments. The money for investments will be taken from its three-year $3 billion fund launched in 2015, which is dedicated to investing in new technologies. Standard Chartered hasalready investedin the distributed ledger network Ripple, with which itdevelopeda new cross-border payments platform in November 2017.

- SBI Holdings.The companyaims to raise$450 million for an artificial intelligence (AI) and blockchain fund. The fund will start investing this month and be managed by its subsidiary, SBI Investment. An initial 20 billion yen ($180 million) was raised for the fund in two months and investors include 50 domestic and international financial institutions, as well as nonfinancial companies. Investors will also use the solutions of the fintechs to help them grow. SBI previously launched a fintech fund in December 2015, worth30 billion yen($270 million), which was the biggest fintech fund in Japan back then.

These three funds demonstrate ongoing interest from incumbents in fintechs globally.That these companies are choosing to up their engagement with fintechs suggests they’ve been pleased with their strategic investments in the past, and continue to believe that acquiring new technology will bear more fruit than building in-house. This is good news for the fintech industry, as the three incumbents will likely fund a plethora of fintechs and implement their solutions throughout the next year.

Moreover, we will likely see more incumbents increasing their fintech commitments in response to their own investments starting to pay off, demonstrating a sustained focus among legacy players on working with these startups.

Maria Terekhova, research analyst for BI Intelligence, Business Insider’s premium research service, has written the definitive Fintech Ecosystem report that:

- Looks at how the environment in which the fintech industry operates is changing, and what that means for the digitization of financial services.

- Gives an overview of the main subsegments within the global fintech industry, and discusses which categories have had to adapt to survive, which have reaped benefits from their original game plans, and which new segments have come to the fore in the past twelve months.

- Outlines the adaptations that incumbent financial institutions have begun making to adjust to an economy that’s inevitably shifting to digital, and in which tech-savvy fintechs are increasingly setting the standards.

- Discusses what the future of financial services will look like as fintech embeds itself into the financial mainstream.

Interested in getting the full report? Here are two ways to access it:

- Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>Learn More Now

- Purchase & download the full report from our research store. >>Purchase & Download Now

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends