BI Intelligence

BI IntelligenceThis story was delivered to BI Intelligence “Payments Briefing” subscribers hours before appearing on Business Insider. To be the first to know, please click here.

Visawillacquire Fraedom, a “payments and transaction management” software-as-a-service (SaaS) company, for an undisclosed financial amount. Fraedom works primarily in the business-to-business (B2B) payments space, offering digital-first solutions to financial institutions and corporate clients, according to the two firms.

Visa and Fraedom were already partners — Fraedom powers Visa’s IntelliLink Spend Management Platform, which small businessescan useto digitally track and manage spending via Visa corporate or business cards — so an acquisition could deepen their joint efforts and help them reach more customers. The deal, which will propel B2B innovation, is expected to close this quarter.

Visa has been targeting B2B innovation:

- There’s considerable room for innovation in B2B payments.B2B payments are challenging for firms, which are tasked with managing both the payable and receivable end of transactions. That’s slowed down digitization, and created a paper-heavy, time-consuming, expensive, and often fraud-filled process that remains a pain point for businesses.

- That’s made the space an area offocusfor Visa.Just because B2B isn’t digitizing doesn’t mean that businesses don’t want it to — the most recent edition of an AFP survey found that70%of organizations were “very or somewhat likely” to convert many of their B2B payments to digital within the next three years. This shift has opened a major opportunity for players like Visa that already work with merchants and can provide them with solutions they may have been unable to access in the past. And it’s led Visa to identify B2B, which it estimates as a$19 trillionspace led by accounts payable and marketplace payments, as a “significant growth opportunity,” through products like virtual cards and automation, among others.

Fraedom brings some assets to the table that could help accelerate Visa’s existing push into the space. Visa is aggressively moving into the B2B payments space through new programs like Visa B2B Connect — which will launch this year and gives banks a secure and fast way to process cross-border B2B payments — and the Visa Ready Program for Business Solutions, as well as partnerships with firms like NovoPayment in Latin America, Validus in Singapore, and Billtrust in the US.

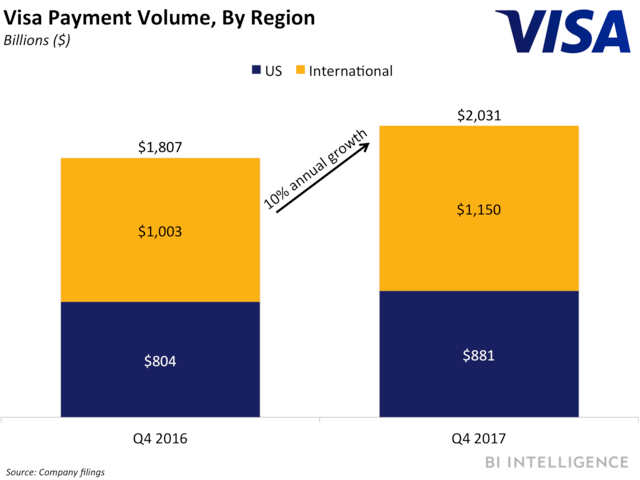

But the acquisition is the company’s largest step so far. Fraedom is a big company — it’s served 173,000 companies and has processed over 1 billion transactions worth $270 billion since its founding in 1999. Although that’s just a small share of Visa’s overall volume — the firm processed $2 trillion in Q4 2017 alone — Fraedom has a wide suite of offerings, including virtual cards and back-end products, that align with Visa’s B2B priorities and could help it quickly and conveniently scale its B2B offerings, ultimately boosting Visa’s volume and helping it meet goals in a key area.

BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on B2B payments that:

- Sizes the B2B payments market relative to other major US payment segments

- Explains how the B2B payments process works, and what makes it so complicated relative to consumer payments

- Discusses the pain points associated with analog B2B payments

- Analyzes the factors behind eroding barriers to industry digitization

- Evaluates what it will take to eventually build up an industry-wise digital payments standard

Interested in getting the full report? Here are two ways to access it:

- Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >>Learn More Now

- Purchase & download the full report from our research store. >>Purchase & Download Now