This story was delivered to BI Intelligence “Payments Briefing” subscribers. To learn more and subscribe, please click here.

Three companies — wearables provider FitPay, semiconductor manufacturer STMicroelectronic (ST), and software firm G&D — have teamed up to create a product that will make it easier for wearable manufacturers to incorporate secure payments, according to an ST press release.

The product includes an operating system from G&D, payment app software from FitPay, and hardware, all of which are integrated around an ST chip. The solution is meant to help device manufacturers “develop integrated tokenized payments” from major players, according to the release.

The move could help wearable-based payments become more popular. Adults in major markets like wearable payments — 61% of Apple Watch owners used their smartwatch to make payments, for example. A product like the one these firms are launching could make it easier for manufacturers offer these services to consumers, which might be key in getting adoption.

That could help payment functionality, which BI Intelligence forecasts will be included in 62% of wearable-device shipments by 2020, become more common among wearables. And as the wearables market is on the decline, it could give more manufacturers access to a tool that might convince consumers to buy their offering.

The rapid expansion of the Internet of Things (IoT) offers payments companies an opportunity to expand beyond mobile phones, cards, and point-of-sale devices, to a broad and diverse ecosystem of internet-connected devices.

We forecast that there will be 24 billion connected devices installed globally by 2020, up from nearly 7 billion today. And over 5 billion will be consumer connected devices by 2020, representing a massive expansion of touchpoints that could eventually offer payments functionality.

BI Intelligence, Business Insider’s premium research service, has compiled a detailed report that dives into the budding industry of connected device payments, providing a rundown of the stakeholders driving innovation in wearables, connected cars, and connected home devices. It also gauges the impact of new payment devices on different payments companies, along with how these devices could shift consumer purchasing behavior.

Here are some of the key takeaways from the report:

- The Internet of Things is ushering in a new era for payments companies and manufacturers.The rapid expansion of the Internet of Things (IoT) offers an opportunity to facilitate payments beyond mobile phones, cards, and point-of-sale terminals, on a broad and diverse ecosystem of internet-connected devices.

- More transactions could eventually pass through connected devices than smartphones. We estimate there will be 24 billion of these devices by 2020, with 5 billion of them being consumer-facing. This represents a massive expansion of touchpoints where payments could be enabled.

- Card networks have developed a basic framework to enable commerce in everyday devices. Visa and MasterCard are creating the underlying infrastructure to support the standardization of payments integration and stake themselves out as the key connected payments gatekeepers. Their payment platforms are universal, allowing digital payments to grow without being tied to the success of a particular manufacturer.

- Consumer-facing IoT companies have much to gain from enabling payments in their devices, including improving the value of the device, being able to cross-sell products through the device, and laying the groundwork for future opportunities to earn incremental revenue. For payments companies, connected payments offer a new revenue stream and an opportunity to gain market share ahead of competitors.

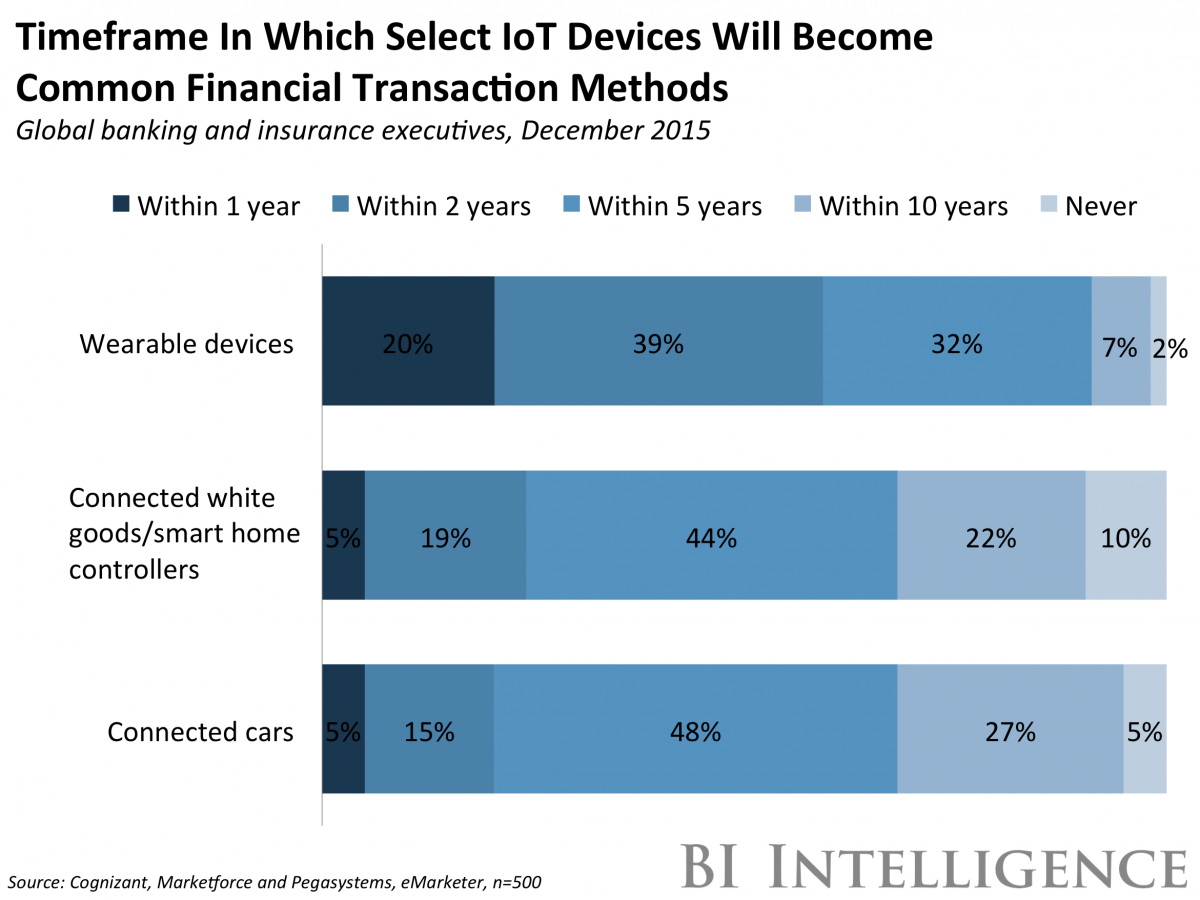

- Wearables, connected cars, and smart home devices will be the top connected payments product categories.

In full, the report:

- Frames the opportunity for embedding commerce capabilities in new devices.

- Explains how a device becomes commerce-enabled.

- Discusses the potential for payment-enabled wearables, connected cars, and smart home devices.

- Examines the impact of connected payments on key stakeholders.

To get your copy of this invaluable guide, choose one of these options:

- Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> START A MEMBERSHIP

- Purchase & download the full report from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of connected device payments.

Learn more:

- Credit Card Industry and Market

- Mobile Payment Technologies

- Mobile Payments Industry

- Mobile Payment Market, Trends and Adoption

- Credit Card Processing Industry

- List of Credit Card Processing Companies

- List of Credit Card Processing Networks

- List of Payment Gateway Providers

- M-Commerce: Mobile Shopping Trends

- E-Commerce Payment Technologies and Trends