Today I received a very frustrating letter in the mail. Before we get to that, though, let’s back up a few steps, and take care of some of the basic questions people ask whenever you start talking about insurance:

I am 27, and I’ve been with GEICO in some form or another since I started driving. I have no tickets on my license. I have two claims on my insurance. The most recent is a comprehensive claim from a few months ago when another car hit a piece of debris on the road, which then bounced into my door, not causing a dent, but putting a nice 4” long scratch through the paint. The other is from just a few months shy of 5 years ago, when another vehicle hit me, for which I was found not at fault (he tried to go around me as I was turning left, and hit the side of my car.) I currently qualify for GEICO’s accident forgiveness program. My payments are automatically scheduled, and never late.

That’s all of the skeletons in my closet. I am, for all intents and purposes, a good GEICO customer. Except apparently I’m not, because I autocross.

Advertisement

For the uninitiated, autocross is… well, let’s quote the SCCA Solo Rulebook:

“A Solo® Event is an automobile competition in which one car at a time negotiates a prescribed course, with finishing position based on the time required to complete the course plus any penalties incurred. Where course conditions permit, more than one car may be on course at a time if they are separated by adequate time and distance. A Solo® Event is a non-speed driving skill contest such as, but not limited to, autocrosses and slaloms. These events are run on short courses that emphasize car handling and agility rather than speed or power. Competition licenses are not required and hazards to spectators, participants, and property do not exceed those encountered in normal, legal highway driving. All Solo® Events must be SCCA® sanctioned.”

Sponsored

If you’re still unclear about what autocross is, it’s basically an empty parking lot, where cones are placed to form an obstacle course that you then drive through as quickly as possible. It’s essentially the safest form of fun you can have with your car. You aren’t messing around on public roads, putting yourself and others at risk. You aren’t on a race track where one wrong move can send you backwards into a tire wall at 100 MPH. Nope. You’re in an empty parking lot with a bunch of cones. It’s about as safe as you can get. It’s so safe that parking lots with cones are the first place they bring people when they are first learning how to drive!

I participate in autocross. I think it’s great fun, and a fantastic way to learn proper car control in a safe, and controlled environment. In fact, it’s such a good tool, that I sometimes wondered if I could get a discount on my insurance for participating in them, much how you can get a discount for taking certain defensive driving courses. I’ve also participated in winter autocross, which is sometimes called ice racing, but it’s essentially the same thing: a vast, open frozen lake, with some cones marking a course that vehicles individually navigate. That’s an even better tool for teaching you how to drive on slick roads in the winter. Things I have never participated in include track days, or any form of wheel-to-wheel racing.

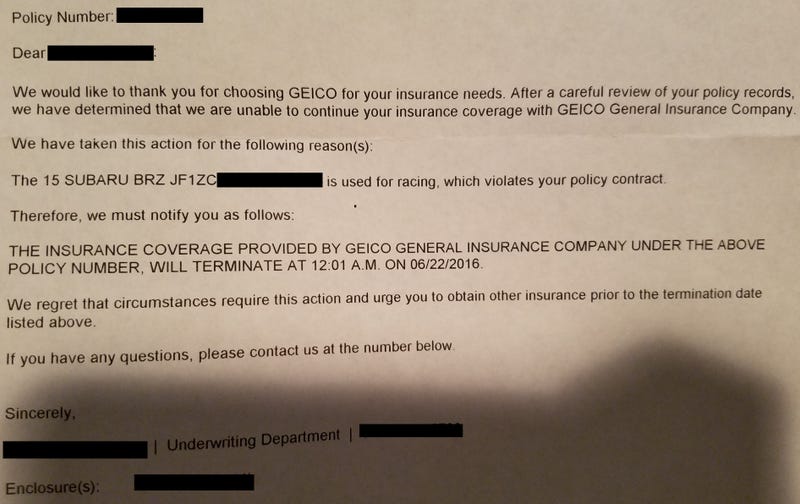

This is why I was shocked to receive this letter in the mail today:

That’s right. GEICO has reviewed my “policy records” and determined that I race my car, which violates their contract, and as such they have decided not to renew my policy. This really does come out of nowhere for several reasons:

Advertisement

1. I have been autocrossing for a while. I did quite a few of them last year, and I’d done a handful before that. I know TONS of people who do the same, and I’d personally never heard of this happening to anyone – at least not for autocrossing.

2. My only claim in the last four years was for a small scratch in the paint, so it’s not like I’ve been randomly claiming damage left and right that could raise suspicion of being racing-related.

3. I can’t find anywhere in my contract that actually states you can’t race the car anyway.

This third point is really bothering me. GEICO claims that my BRZ “is used for racing, which violates [my] policy contract.” They are explicitly stating that the reason they are not renewing my policy is because I violated the contract by racing my car. I have looked over my contract three times (which you can look at here), and I’ve only found four instances of anything being mentioned with regards to racing. I have quoted them here:

In the Liability Coverages section:

“[It does not apply] to bodily injury or property damage caused by an auto driven in or preparing for any prearranged or organized racing, speed, or demolition contest or stunting activity of any nature.”

In the Auto Medical Payments section:

“We do not cover bodily injury or property damage caused by an auto driven in or preparing for any prearranged or organized racing, speed, or demolition contest or stunting activity of any nature.”

In the Physical Damages Coverage section:

“There is no coverage for any loss caused by participation in or preparing for any prearranged or organized racing, speed or demolition contest or stunting activity of any nature.”

In the Uninsured Motorist Coverage section:

“This coverage does not apply to damage caused by an insured2s participation in or preparation for any prearranged or organized racing, speed or demolition contest or stunting activity of any nature.”

So essentially, they won’t cover any claims or incidents that are a result of my participation in any racing event. Which is fine, and reasonable, and what I always knew to be true. Nobody expects insurance to cover that. That’s why people buy track day insurance. However, none of these statements translate into “you cannot race your car,” and if anything suggest the opposite, since it seems like they are intentionally excluding incidents stemming from racing in their coverage, as if to say, “just know that if you wanna do that stuff, we aren’t covering it.”

I realize that insurance companies generally have the right to refuse to renew your coverage for any reason. What really rubs me the wrong way is that they explicitly listed the reason as being that I violated my contract by racing my vehicle. I’m not so sure autocross counts as racing, but even if it does, NOWHERE in the policy does it state you can not use the vehicle in that manner. It simply says they won’t cover damages or claims related to those activities. I would be less annoyed if they had said they were dropping me “just because,” because at least then they wouldn’t be accusing me of something I did not do.

I will definitely be calling and asking them to point out the clause in my contract that says I cannot race my vehicle. I’m also curious to find out what proof they have that my BRZ is used for racing. I don’t think autocross should count, but in any event I’m really curious to know what it was that caused them to freak out on someone who has been a good, loyal, money-making customer for them for many, many years. Whether it’s my blog where I post videos of my autocross runs, or something else floating around the internet, or what… I’m not looking to deny that I do it – I just want to know what it was that they didn’t like, specifically. The only thing that really comes to mind is this post my friends pointed out, where I used the word “racing” to describe a weekend of autocross:

What a great way to end a miserable evening. Ironically, I just spent 1.5 hours on the train to get home from work, because I decided not to drive today since we might get some freezing rain tonight, and I didn’t want to risk driving my car on summer tires in icy conditions. (You’re welcome, GEICO. I’m always looking out for you guys…)

Also, does anyone have suggestions about which insurance providers I should look into going forward? And should I be up-front with the use of the car, and try to work out some sort of agreement of “we won’t cover racing damages?” Or am I better off not mentioning it?

I run a blog too,http://www.seriesblueadventures.com/, so I do post publicly about the things I do. It wouldn’t be fun to not share my experiences!