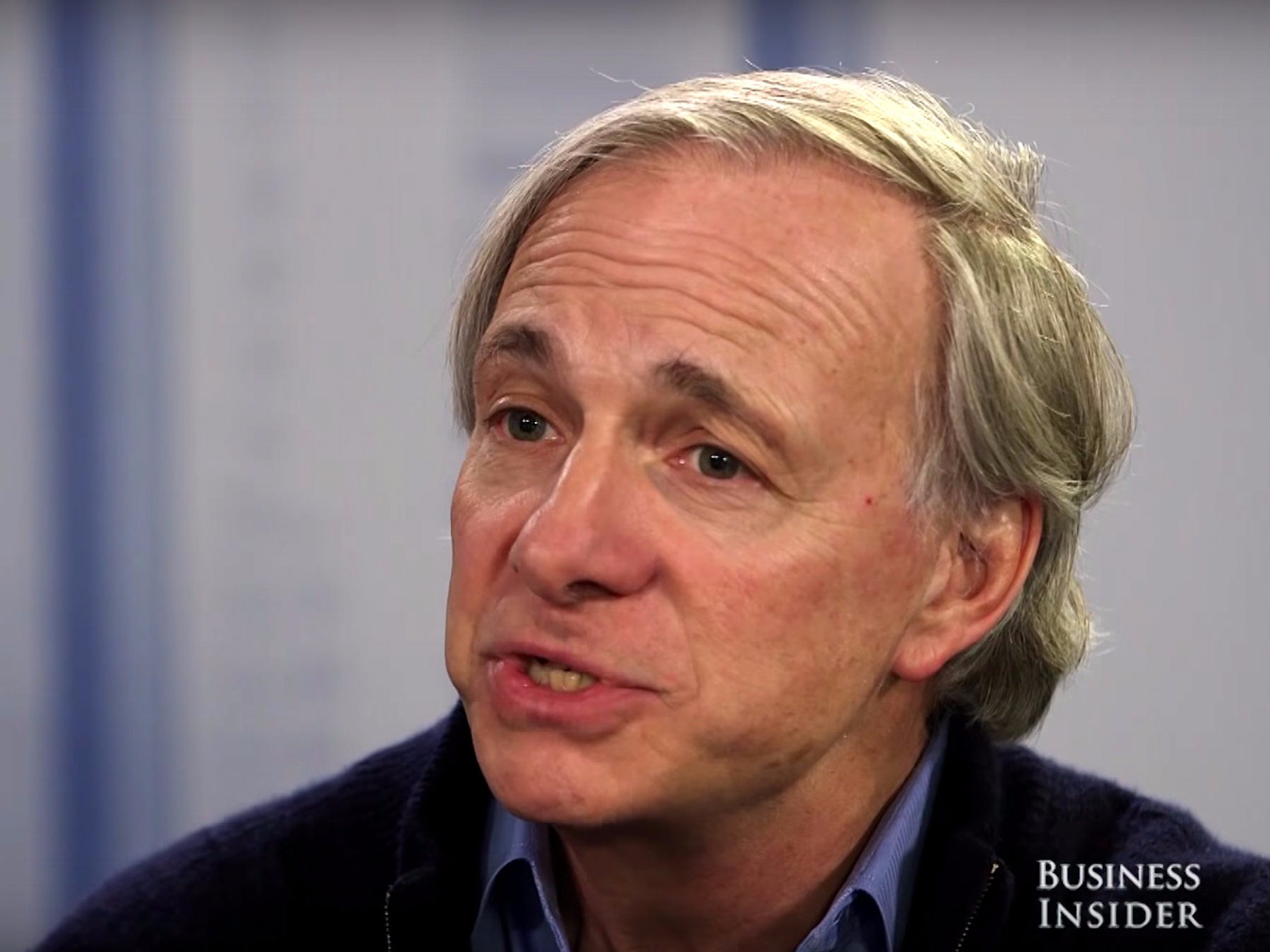

Bridgewater Associates founder and co-CIO Ray Dalio is as well known for his remarkable investing career as he is for his unusual approach to management. To him, both are intertwined.

In an interview with Business Insider’s global editor in chief Henry Blodget on “The Bottom Line,” BI’s new weekly business show, Dalio laid out the fundamental investment philosophy that led to Bridgewater’s becoming the world’s largest hedge fund in 2005.

It’s maintained that position ever since, and as of mid-year 2016 managed $103 billion in hedge find assets with $150 billion in total assets under management, according to HFI.

Not long after founding Bridgewater Associates out of his apartment in 1975 (a proper office in Westport, Connecticut didn’t come until 1981), Dalio realized that he could continue improving his returns by solidifying recurring lessons into “principles,” an approach he would later apply to employee management, as well.

“What I did every time I made a mistake — they became painful mistakes — but with time I realized that reflecting on those mistakes would give me gems,” Dalio told Blodget. “And I’d write down a rule.”

Those rules accumulated into investing principles, which Dalio then translated mathematically into computer algorithms so he could test their accuracy by applying them to past market movements.

“And by putting all those rules together, and then having these algorithms, the computer could replicate my thinking,” he said. “But it could actually think better than I could because what it would do is … it could process more information, it could process it faster, it could process it less emotionally.”

Dalio likened building Bridgewater’s portfolio in the early days to driving with a GPS. He was in charge of the car, but he had an automated system guiding him along. “And to have that next to me was invaluable. It would learn; I would learn.”

He said that the major benefit of this approach was being able to gain more insight into optimal asset diversification.

“People think that the way that you do best is to have the best possible bets,” Dalio said. “The way that you do best is to have the best possible diversification.”

“I learned that if I could have 10 or 15 uncorrelated bets, and they’re all about the same return, that I could cut my risk by 75% or 85%,” he added. “That would mean that I would increase my return to risk ratio by a factor of five through diversification.”

Dalio developed Bridgewater’s core investment principles through the 1980s, and then in the 90s applied that approach to people management. He eventually collected these in an employee handbook, simply titled “Principles,” which is available online and will be published in book format by Simon & Schuster in the fall. In recent years, these management principles are increasingly becoming automated, as well, through applications like proprietary in-house iPad apps.

A primary lesson of these management principles are essentially what triggered those from the investment side: “Pain + Reflection = Progress.”

“Because you know the same things happen over and over again,” Dalio told Blodget. “The same things happen over and over again in the markets — everything that we’ve been through, every cycle. Everything has happened in the past. The same thing happened over and over again in politics. Same things happen over and over again in our lives.”

If you can recognize this and have a way of anticipating recurring behavior — whether it’s in markets or in people — Dalio said, “that’s an effective way of approaching the game that you’re playing.”

You can watch the first episode of “The Bottom Line” through this link, and watch Dalio explain how he learned to invest below.